Boston-based Eastern Bank will make its first bank acquisition since going public six months ago by acquiring Medford-based Century Bank in an all-cash deal valued at $642 million. The move will triple Eastern’s market share in Middlesex County and mark its entry into marijuana banking.

The banks announced the deal in a statement Wednesday evening. The merger agreement has been unanimously approved by both boards of directors, the banks said in the statement.

Eastern said it would use cash on hand from its balance sheet to fund the purchase. Century shareholders will receive $115.28 in cash for each share of Century Bancorp Inc.’s common stock, and the $642 million purchase price represents 1.75 times Century’s tangible book value as of Dec. 31, according to the statement.

Eastern converted from a mutual to a stock bank in October, raising approximately $1.7 billion in its initial public offering.

The acquisition is expected to close in the fourth quarter, subject to regulatory and shareholder approvals and other standard conditions. In a conference call today to discuss the merger, Eastern’s chief financial officer and chief administrative officer, Jim Fitzgerald, said that while the exact timing of the closing was not yet known, it could happen in the earlier part of the fourth quarter.

Century’s directors and executive officers have agreed to vote in favor of the merger, according to the statement. Eastern will be the surviving bank in the deal, and Century Bank branches will assume the Eastern Bank name.

“Our complementary business models and shared values make this partnership a natural fit,” Barry R. Sloane, Century Bank’s chairman, president & CEO, said in the statement. “Both organizations are highly respected as leaders in the community, and we believe Eastern’s focus on innovation and technology will help to further ensure Century customers have greater access to banking products and services that meet their needs where and when they need them.”

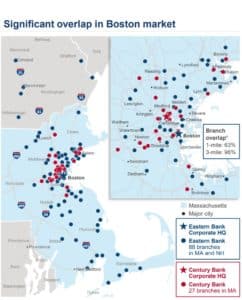

The combined bank will have approximately $22 billion in assets. Eastern is the largest bank headquartered in Massachusetts with approximately $16 billion in assets, and Century Bank has about $6.4 billion in assets, making it the seventh largest bank headquartered in Massachusetts, according to FDIC data. Century has 27 branches in the Greater Boston area, and Eastern has approximately 90 bank branches in Eastern Massachusetts and New Hampshire.

“We’ve admired Century’s success since its founding by Marshall Sloane in 1969 and today they are New England’s largest family-run bank,” Eastern Bank chairman and CEO Bob Rivers said in a statement. “Under the leadership of Barry R. Sloane and Linda Sloane Kay, the Century Bank brand has continued to rise in prominence and it was a proud moment for us when they communicated they wanted to partner with Eastern. We are excited for the opportunities this agreement creates and believe our combination will deepen our reach in providing banking services and other support to communities across Greater Boston and southern New Hampshire.”

Rivers had said during Eastern’s fourth quarter earnings call in January, its first earnings call as a public bank, that the bank planned to look for merger and acquisition opportunities in its market. At the time, Rivers said he did not anticipate any immediate opportunities, but added that he had made it known in the market that the bank was looking for opportunities.

During the conference call for investors this morning, Rivers said the deal was “truly a historic moment for Eastern.”

“This is an opportunity to partner with one of Boston’s legendary families and banks whose values and commitment to community reflect our own,” Rivers said. “It’s an opportunity to integrate a high performing company that generated record earnings in 2020.”

In response to an analyst’s question, Fitzgerald declined to provide details about how the deal came about or whether Century Bank had other bidders. He did note that Century was well known as a valuable franchise in the market and that Eastern was “very excited when we first started working on the transaction.”

No one from the Century’s board of directors will join Eastern’s board, which Rivers said was typical when acquisitions are done as all-cash deals.

Rivers noted that the deal would triple Eastern Bank’s market share in Middlesex County, giving it the third largest market share in Massachusetts’ most populous county. Because the banks have significant overlap in other areas of Greater Boston, branches will close. Fitzgerald said Eastern and Century were still finalizing how many branches would close.

Eastern Bank and Century Bank footprints. Image courtesy of Eastern Bank investor presentation.

The merger will give Eastern Bank opportunities to cross-sell its insurance and wealth management products and services with Century Bank’s customers.

The combination will also mark Eastern Bank’s entry into marijuana banking. Rivers noted that Century is the state’s largest marijuana banking enterprise.

“That’s something that I believe only three other banks in the market have done, something that we haven’t done in the past, but one that we’re excited to learn and something that certainly Century has been a leader in,” Rivers said.

Rivers added that Eastern Bank would also benefit from two of Century’s other lending specialties, health care and higher education, areas where Eastern did not compete with Century.

This is the third deal involving banks with significant market share in Massachusetts this year, but the first involving banks in the same market. Boston Private is looking to sell itself to California-based Silicon Valley Bank, and Connecticut-based People’s United Bank has agreed to be acquired by Buffalo-based M&T Bank.

Updated April 8, 2:46 p.m.: This story was updated to reflect the correct total assets of the combined entity following the proposed Eastern Bank-Century Bank merger. The combined total will be $22 billion.