Lawmakers in Washington spent the last few months of 2017 arguing over the Tax Cuts and Jobs Act, which would eventually pass, slashing the corporate income tax and reducing the income tax, along with a host of other provisions.

But baked into the controversial law was a bipartisan tax incentive that would encourage investment in qualified opportunity zones that have been designated all over the country.

The Internal Revenue Service is expected to release final guidelines for opportunity zones soon and experts say the time to start preparing for interested parties is now.

“Where the banks I think will be impacted mostly is from the demand that maybe created or investment in opportunity zones,” said Ronald Homer, who is based in Boston and leads RBC Global Asset Management’s global asset management impact investing efforts. “I think there will be more capital available seeking to invest in areas that qualify for CRA (Community Reinvestment Act) credit.”

“We work with towns and cities with the goal of educating people in those towns, so they can take advantage of the incentive,” added Matthew Osborne, senior commercial banking officer at Eastern Bank. “The tax benefits of an opportunity zone flow to the investor, not the bank lender. We would look at redevelopment projects regardless of whether they are in an opportunity zone or not. What we hope an opportunity zone does is bring investors into a project they may have not otherwise looked at.”

Bram Berkowitz

How It Works

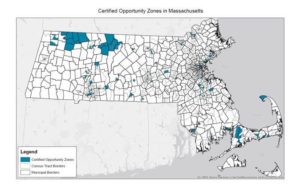

Gov. Charlie Baker’s office earlier this year designated 79 opportunity zones in Massachusetts including 13 in Boston, five in Lowell, four in Brockton and one in Cambridge. Osborne said the opportunity zones are similar to census tracts that follow the previous new market tax credit program.

With opportunity zones, investors, which could include real estate developers, pension funds, hospitals, colleges and high net worth individuals, can defer their capital gains tax for 10 years if they reinvest a gain or a portion of that gain into a real estate project in an opportunity zone.

Projects that are applicable include real estate development or rehabilitation, opening new businesses, acquiring an existing business and relocating it to an opportunity zone or expanding an existing business already in an opportunity zone.

If investors maintain their investment for seven years, they can get up to a 15 percent discount on the taxes due on this gain. If they keep their money invested for 10 years or more, they will get tax free growth of the original capital gain invested.

Homer said RBC Global Asset Management projects that the tax break will increase returns on projects by 3 percent per annum, making up for projects that may not have a high return initially.

Early estimates say the program could generate up to $100 billion over the next few years. There is also an estimated $6.1 trillion of potential unrealized capital gains eligible to invest in over 8,700 designated opportunity zones across the country, according to the Economic Innovation Group.

Timing Is Everything

As Banker & Tradesman went to press, the final guidelines from the IRS had not been released, but when they are, which is expected by month’s end, investors need to be ready to move.

The economic opportunity zone program, similar to the tax reform bill it is attached to, is supposed to end in 2026. This means that to have invested for seven years and therefore qualify for the 15 percent tax reduction, participants need to choose projects they are confident about by the end of 2019.

“The biggest question is timing,” said Osborne, who said Eastern Bank is meeting with stakeholders in gateway cities to help get them ready to act. “Because of how the program is set up, developers will need to get approvals in a tight time frame. Sometimes this process can move fast and sometimes it can take an extended time.”

Other questions related to timing, said Homer, include how the 10-year tax deferral will work considering the program is expected to end in 2026, and how long will developers have to complete real estate rehabs and additions.

While there is lots of uncertainty surrounding the program, Osborne feels confident that the industry will be able to take advantage of it, as it has in the past.

“There has been lots of legislation that involves tax incentives to drive development. Some have been from LITEC (low income housing tax credit) and others from the new market tax credit,” he said. “Often when new legislation has come out, it can be confusing because it’s new. But I think the industry itself has proven that it can read through, understand and execute on it.”

This story was updated on Oct. 22 to correct the name of RBC Global Asset Management.

|

|