Boston’s housing costs have continued to rise for six straight years, starting from a low point in 2011. Recently rent prices in Boston have begun to drop moderately, for the first time since the recovery began in 2011. Where is the current market now and ultimately, where might it go? GeoHome, a real estate big data startup, shares its predictions:

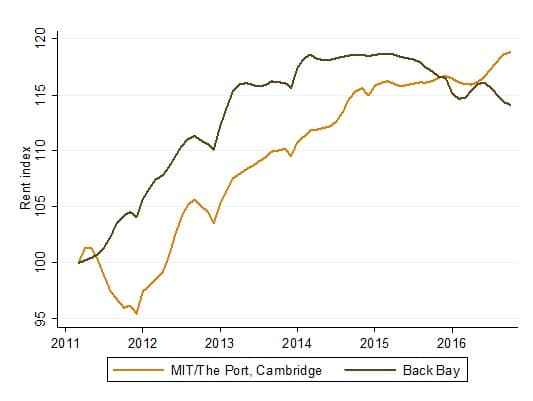

Figure 1: Rent index as a percent of 2011 for MIT/The Port and Back Bay.

1. Downward pressure is accumulating within neighborhoods that have experienced an increase in new construction projects.

As the leading city for the second round of urbanization in the United States, Boston is experiencing a surge of building permit applications, the likes of which haven’t been seen in the last 60 years. In the past couple of years, over 5,100 apartment units have been built, with another 7,200 apartment units currently under construction that will soon be on the market, according to a recent market report from commercial real estate data firm REIS.

Most of these new buildings concentrate around central and south Boston with the majority of them in the high-end luxury condominium or apartment category. The introduction of this new supply to the housing market will make Boston housing more affordable – or result in a significant downward pressure on rents, which could in turn reduce house prices, depending on your perspective.

Several neighborhoods, including the Back Bay, Bay Village and the South End, are beginning to experience this downward pressure at a higher rate than usual. On the other side of the river, neighborhoods near the MIT campus, such as Cambridgeport and Area 4, are benefiting from strong job growth and the anticipated MIT expansion, and therefore show no signs of decreasing rental rates.

Below is a graph of the rental changes provided by GeoHome, calculated from Zillow’s rent index, for all homes plus multifamilies. From the graph below we can see that rental rates in Back Bay peaked in 2014, then plateaued until 2016, when the rent index for the neighborhood started to drop. During the same period, rent for neighborhoods surrounding MIT kept rising without any sign of dropping, despite Boston’s general trend of moderate decreases in the rental rates.

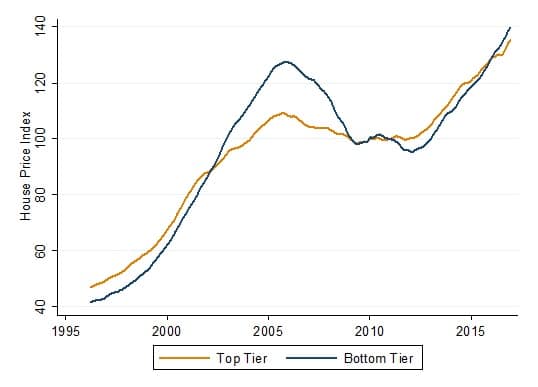

Figure 2: House price index for top tier districts and bottom tier districts.

2. Top tier districts will see less appreciation than bottom tier districts.

In the next couple of years, bottom tier districts, measured by Zillow’s house price index, will see higher appreciation than the top tier districts. Historically speaking, the Boston real estate market has the following patterns: high income neighborhoods, which generally correlates with top tier house price neighborhoods, lead both the rise and subsequent decrease of housing prices, and in each cycle, the variation for top tier districts is smaller than bottom tier districts. In other words, top tier districts appreciate less and drop less than bottom districts. This pattern holds true for Boston not only in last boom-bust cycle but also in the 1983 to 1998 cycle (Case and Marynchenko, 2002). It might worth mentioning that the pattern of low income districts experiencing larger home value growth and decline than high income districts is observed in almost all major U.S. metropolitan areas in the last real estate cycle, but only some metropolitan areas in the 1990s cycle.

One important sign that the Boston housing market has reached the final stage before prices begin to decline is that bottom tier areas are experiencing housing price increases at a rate faster than the price increases being experienced within the top tier districts. From the summer of 2016, bottom tier area prices rose faster than the top tier area, indicating that the bubble is taking shape.

Xiaowen Yang may be reached at xiaoweny@geohomeusa.com or (617) 4318416.

This article first appeared on GeoHomes’ website; click here to see the original post.