As Massachusetts starts to move towards ending its stay-at-home advisory, signs suggest sellers are beginning to return to the housing market.

Greater Boston’s residential real estate market is showing initial signs it could be coming back to life, with new listings up significantly on a week-over-week basis on the high and low ends of the market.

New data from the Zillow Group shows new listings in the area are up 18.2 percent overall week-over-week for the seven days ending May 3, with the median list price sitting at $601,636, a 1.6 percent increase from this time last year. That compares to the 2019 median sale prices in Greater Boston’s biggest submarket of Middlesex County – $557,750 for single-family homes and $467,000 for condominiums – according to The Warren Group, publisher of Banker and Tradesman.

New pending sales were also up 4.4 percent week-over-week in Greater Boston for the seven days ending May 3 and up 4.6 percent week-over-week for the week ending April 26.

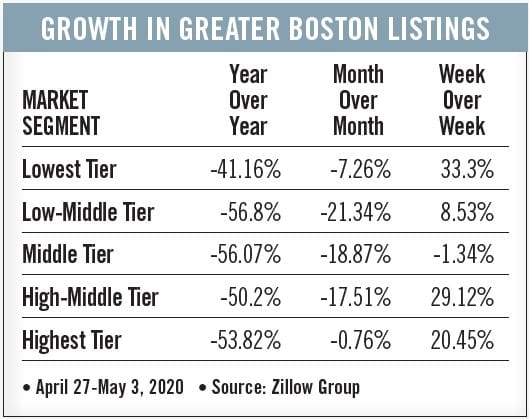

As a measure of how dramatically the market stalled when the coronavirus hit Massachusetts, the number of new listings was down almost 52 percent year-over-year for the week ending May 3. For the four weeks ending April 26, the number of active listings was down a little over 27 percent year-over-year and the number of new listings was down almost 58 percent. The number of pending sales was down almost 57 percent.

Zillow’s statistics show the uptick in new listings is concentrated at the high and low ends of the market. While the number of listings in the most expensive fifth of the market are down 54 percent year-over-year in the week ending May 3, they are up 20 percent week-over-week and only down 1 percent month-over-month. A similar pattern is seen in the lowest-priced fifth of the market, with the number of listings there down 41 percent year-over-year and 7 percent month-over-month, but up 33 percent week-over-week.

Credit Availability Increases

As homes in the upper tranches of Greater Boston’s market come onto the market, lenders appear to be loosening up credit availability for jumbo mortgages, said Arlington-based Leader Bank Senior Vice President Jay Tuli, something that will be important if homes on the higher end of the market are to transact.

Zillow figures put the current Greater Boston median asking price at $601,636, while the 2020 conforming loan limit for the five-county Greater Boston region is $690,000. Nationwide, availability of conventional mortgages decreased 15.2 percent over the course of April, while the availability of government-backed loans decreased by 9.5 percent, according to the Mortgage Bankers Association. Availability of jumbo mortgages decreased by 22.6 percent, and availability of conforming mortgages fell by 7.1 percent.

“It’s not back to where it was pre-coronavirus, but it’s definitely loosened up a bit,” Tuli said. “I think part of that is just a little more certainty in the world. Part of that is banks understanding more about who is affected and who is not.”

With state jobless claims figures showing the pain of the coronavirus-caused shutdowns concentrated in the retail, construction and hospitality sectors, plus self-employed workers and independent contractors, lenders are applying greater scrutiny to a mortgage applicant’s sources of income, Tuli said. Lenders are increasingly asking self-employed applicants and business owners for additional documentation about the financial health of their operations and are seeking to verify ordinary workers’ employment shortly before and after a closing.

Sellers Motivated, and Opportunistic

The local dynamics are mirrored by national upticks in these segments, as well. New listings in the top fifth of the market were the first to drop off and fell below last year’s totals before homes in other price tiers. Expensive homes also had the steepest fall of any price tier, dropping 51.4 percent below last year by mid-April. Meanwhile, listings of the most-affordable homes – where there typically is the tightest inventory – have fallen 32.1 percent year over year at their lowest point. Nationally, the number of new listings has risen for three straight weeks.

Zillow economists say the split in the market’s different segments may be related to the reasons sellers typically list: younger owners who tend to own cheaper homes face more pressure from the arrival of a new job offer or child, while sellers of higher-end homes tend to have the resources to be flexible.

James Sanna

“Many sellers with the flexibility to delay or temporarily remove listings have opted to do so, perhaps waiting out the uncertainty. Now that more buyers are in the market, those sellers are wading back in, joining those who had remained motivated to sell for any number of life reasons and adapted with virtual tools and social distancing,” Skylar Olsen, senior principal economist at Zillow, said in a statement. “We have not yet seen prices affected, though we expect them to fall modestly on a national level as the pandemic plays out.”

These changes occur as 1.07 million workers in Massachusetts have filed first-time claims for unemployment benefits since the pandemic began, equivalent to 29 percent of the workforce.

|

|