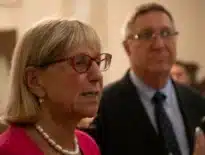

Gov. Maura Healey, Lt. Gov. Kim Driscoll and Secretary of Housing and Livable Communities Secretary Ed Augustus during a press scrum following Healey's signing of the Affordable Homes Act on Aug. 6, 2024. Photo by Steve Adams | Banker & Tradesman Staff

Gov. Maura Healey inked a $5.16 billion bond bill designed to rein in Massachusetts’ housing costs through increased funding for public and private developers.

Potentially the most notable legislation enacted in the past legislative session, the Affordable Homes Act legalizes accessory dwelling units statewide, encourages office to housing conversions and earmarks $2 billion for public housing construction and renovations.

At 2Life Communities’ Golda Meir House senior living community in Newton, Healey signed what administration officials characterized as the most significant housing legislation in Bay State history as hundreds of housing industry figures looked on.

“Land is expensive. Zoning is tough. Interest rates are up,” Healey told a crowd of hundreds of housing industry figures. “We understand the reasons, but this bill is a turning point.”

The bill triples the state’s previous five-year housing spending, including $2 billion for public housing projects.

The most significant zoning reform allows construction of accessory dwelling units up to 900 square feet in all 351 communities. The administration estimates it could spur up to 10,000 such in-law apartments.

A notable provision: A $50 million momentum fund will be allocated by Massachusetts Housing Finance Agency to help housing developers with approved projects complete financing packages.

In the wake of interest rate hikes, some developers and industry groups have called upon state and local officials to dedicate public funding to bridge financing gaps that are preventing approved housing projects from breaking ground.

At least one large-scale multifamily project, developer Ad Meloria’s 273-unit 1717 Hyde Park Ave. which was approved in 2020, has filed for bankruptcy and others are waiting for financial conditions to improve. Neponset Wharf, a proposed $70 million mixed-use project including 120 apartments on Ericsson Street in Dorchester, filed for Chapter 11 bankruptcy protection in May.

The fund includes a $13 million earmark for The Davis Cos.’ 1234 Soldiers Field Road project, which would be one of the highest-profile developments to break ground in Allston outside of the Boston Landing area.

Approved by Boston officials in March 2023, the estimated $366 million project would include 450 apartments, 93 condominiums and a 195-room hotel replacing the Studio Allson hotel and the former Skating Club of Boston arena.

Davis Cos. Chief Portfolio Manager Cappy Daume last fall said the firm was not actively seeking financing for the project until it was sure it was economically feasible.

The bond bill also targets housing production in seasonal communities such as Cape Cod and the Berkshires where low-wage seasonal workers face limited options, although details of the changes have yet to be determined.

More opportunities to build housing are expected to emerge after the administration completes an inventory of state-owned properties, now scheduled for late 2024, to offer to developers.

“We’re not growing more land. We’ve got to use what we have better and more effectively,” Healey said.