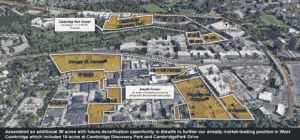

Developer Healthpeak Properties revealed plans to build out a 36-acre life science campus over the next decade on parcels it’s assembling in the Quadrangle section of West Cambridge.

The Denver-based REIT is spending $625 million on recent and pending acquisitions in the district with an opportunity for “significant future densification” of the properties, which currently include surface parking, office and R&D buildings and industrial uses. The acquisitions include a 12-acre site where Boston-based Cabot, Cabot & Forbes had sought approval for a 1 million-square-foot lab and multifamily development since 2019.

“We now have a significant development opportunity on the East Coast to balance our enormous development pipeline in south San Francisco,” CEO Thomas Herzog said in an earnings call today, adding that the massive campus will provide a competitive advantage through “world-class” amenities and opportunities for tenants to relocate within the property. “This is very different than owning a single lab building in an isolated location.”

Healthpeak has staked out a flag as the leading developer in one of Cambridge’s last neighborhoods suitable for large-scale commercial development, previously acquiring $1.2 billion of properties including Cambridge Discovery Park. Competing life science REIT IQHQ bought the 26-acre GCP Applied Technologies campus off Whittemore Avenue last year.

Healthpeak was attracted by the West Cambridge submarket’s “robust fundamentals and tenant demand” and plans to build multiple Class A life science buildings in the coming years, the company said in an investor presentation accompanying the release of its third-quarter earnings Wednesday.

Healthpeak this week closed on the $123 million acquisition of a 12-acre Mooney Street development site where Boston-based Cabot, Cabot & Forbes had been seeking approval since 2019 for a 1 million-square-foot lab and multifamily development. Healthpeak said it will seek “additional entitlements” for the site which, if approved, would trigger a $15-million earn-out payment to the sellers.

Healthpeak also disclosed that it has agreed to acquire 67 Smith Place, a 4.4-acre site acquired by Cabot, Cabot & Forbes for $50 million in October 2020, for $72 million in a transaction scheduled to close in early 2022. The property has future development potential following expiration of leases on the existing 53,000-square-foot industrial building in 2022.

And it plans to spend another $45 million to acquire 110-125 Fawcett St., a 2.4-acre site, by year’s end. That property contains a 53,000-square-foot industrial building suitable for redevelopment and a potential location for a pedestrian bridge connecting to the MBTA’s Alewife station.

Healthpeak was able to secure the acquisitions in approximately six months, executives said.

“The ability to put together 36 acres with a Cambridge address is pretty much unheard of, and that was ultimately the deciding factor to proceed,” Healthpeak President Scott Brinker said during today’s conference call.

Healthpeak made its first acquisition in the Quad in September, when it paid $180 million for the Raytheon BBN Technologies campus.

|

|