As national banks pulled back from local mortgage markets in the wake of the 2008 financial crisis, national nonbank lenders and community banks stepped into the void to capture leading positions in Boston-area submarkets.

Local banks and national nonbank lenders have capitalized on new conditions in Greater Boston’s supply-constrained and super-charged housing market, beating out big banks for mortgage marketshare in the decade since the subprime mortgage crisis.

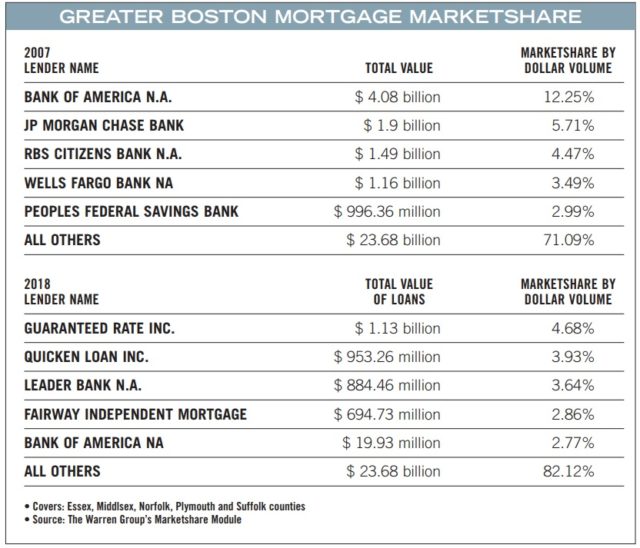

Big banks dominated mortgage marketshare across the region in 2007, with some combination of the same four institutions usually locked in place as top lenders in most places: Bank of America, JP Morgan Chase, Wells Fargo, RBS and Citizens Bank.

Twelve years later the picture is quite different. Local banks and national nonbank lenders lead loan origination in the 20 cities and towns where home sale prices have grown the most in Massachusetts compared to pre-recession median sale prices, according to data from The Warren Group, publisher of Banker & Tradesman.

Financial Crisis Left Opening for New Players

The two institutions that grabbed the most marketshare from the large banks are Guaranteed Rate and Leader Bank; Guaranteed Rate holds a top-five position for total mortgage value in 17 of the 20 communities with the greatest single–family home sale growth, while Leader Bank is a top-five lender in 13.

Smaller intuitions have also done well in their local communities, especially in refinance loans: in Melrose, Melrose Cooperative Bank is in the top five lenders on the strength of its top nonpurchase mortgage portfolio. In Bedford, Hanscom Federal Credit Union cracks the top five for the same reason. Neither institution was in the overall top five in their communities in 2007, and BofA and HSBC were the top refi lenders in Melrose and Bedford, respectively.

The same business model that brought big banks to prominence a decade ago is what eventually brought their downfall, said Jay Tuli, executive vice president of retail banking and residential lending at Leader Bank. Smaller institutions couldn’t compete in the mid-2000s because they were unwilling to take on the risk of low-doc or no-doc subprime loans at the level the large banks could. Those large banks built a business model around absorbing risk and the securitization of mortgages.

“Back then a larger percentage of loans were closer to subprime,” Tuli said. “Smaller banks just couldn’t touch [larger lenders’] ability to take risk and couldn’t be involved and couldn’t compete for marketshare.”

When the subprime mortgage securitization bills came due and lending at the large institutions ground to a halt while they sorted through their books and learned to navigate new government regulation, an opportunity was created for lenders who could better compete with the conditions on the ground.

“The community banks and private mortgage lenders didn’t change a whole lot in their business model [before the recession], so when the big banks pulled back from mortgage lending, healthier firms really jumped in,” Tuli said. “On a local level, [Leader Bank] saw the opportunity and jumped in, and on a national level companies like Guaranteed Rate and Quicken Loans saw the same opportunity and did a great job jumping in.”

Speed Sells

Greater Boston’s current low supply and a booming local economy allow local banks and nonbank lenders to use their strengths: advanced technological platforms, the ability to shop for rates across multiple servicers, and a focus on customer service for Realtors and homebuyers.

The ultra-competitive nature of the local real estate market has required a tweak in the traditional lending model that enables potential homebuyers to move as quickly as possible, said Shant Banosian, a mortgage broker at Guaranteed Rate and the top loan originator in Massachusetts for the past five years.

“What we did, and what Quicken has done a good job of, is really pushing the digital mortgage application,” Banosian said. “We’ve created a platform where you can input your information, and then get information back in a matter of minutes.”

“That speed part of it is huge,” he said. “As the market has recovered and the inventory has gone down, it’s become much more competitive. The banks just don’t have that – they’re not known for speed, they’re not known for communication, and frankly, they’re not open nights and weekends when a lot of business is done. We are.”

Leader Bank, Guaranteed Rate and Quicken Loans each shop for the best rates among servicers and sell their loans, often to the same big banks that no longer dominate the origination market. Banosian said that’s likely intentional – big banks are very much still in the game, they’ve just pulled back a bit from the customer-facing part of the process.

“They’re buying those loans from us to service them, so they probably don’t want to staff up and create that infrastructure [to originate the loans] when they’re going to buy them from us eventually,” he said.

With new technology and healthier business models, community banks and national nonbank lenders were well-positioned to grow their share of the market.

Jumbo Loans a Helpful Tool Inside 128

The big banks aren’t totally out of the game: BofA is in the top five in marketshare in four of the top 20 communities in single–family home sale growth, Wells Fargo is in three, and other large banks still have presences as well, The Warren Group’s data shows. But according to Deb Sousa, executive director of the Massachusetts Mortgage Bankers Association, because values have grown so significantly, local banks might have another leg up over the larger nationals: the availability of jumbo loans.

“When it comes to jumbo mortgages, a majority of local lenders have portfolio jumbo products available which most likely have lower interest rates than those available on the secondary market,” Sousa said.

Jumbo loans are an important tool in the communities where single-family homes have seen huge increases in sale prices since before the recession, according to Sousa, especially communities inside Route 128. Between 2006 and 2018, single–family home sale prices have grown in South Boston by 125.3 percent, in Somerville by 88.8 percent, in East Boston by 74.1 percent, in Jamaica Plain by 70.2 percent and in Roslindale by 64.7 percent, according to The Warren Group.

Banosian said institutions that focus on lending can combine speed to close and the flexibility to offer several different types of loans and are built to succeed in Greater Boston’s current market.

“I offer MassHousing loans, FHA, conventional loans, jumbo loans,” he said. “Our core competency is mortgage lending only. We’re not interested in checking accounts, savings accounts or anything else but mortgages.”

|

|