One of the key weapons in banks’ arsenal as they fight for new customers is a robust rewards card offering. The key challenge is how to provide compelling offers that will attract and retain consumers in a profitable manner. Compounding this challenge is the sometimes-temperate environment of competing priorities between financial institutions (FIs) and their partners.

With loss provisions increasing over the last two quarters and default levels beginning to rise, maintaining profitable rewards card portfolios that meet the needs of the consumer, the FI and the partner in an evolving mobile payments landscape will be crucial.

Aite Group conducted a study to research U.S. credit card users and trends in rewards card offerings. The survey included 1,669 U.S. credit card reward users, industry executive interviews and Aite Group’s existing body of research. It identified trends in the credit card rewards market as multi-promotional marketing, rising credit card debt, risk management and competing priorities.

Issuers combining multiple promotions are driving acquisition and “top of wallet,” but issuers should ask themselves, will short-term incentives translate to short-term use? Household credit card debt is now surpassing pre-recession levels and default rates are beginning to rise. Consumers may soon start deciding which card to keep as a result of these market trends, and a strong rewards program will help in that decision-making process.

Co-branded card partnerships between merchants and FIs can become strained under competing priorities and managing risk. Issuers may implement more comprehensive portfolio evaluations to identify opportunities and mitigate risk.

Players in the industry also face upward trends in mobile wallet and redemption rates and the ease of acquisition and spending.

Growing mobile wallet transactions and real-time redemption capabilities will increase customer loyalty and card spend. Altering consumer transaction behavior and the potential impact to breakage revenue may have unforeseen implications. The digital marketplace has enabled increased speed of acquisition and opportunity to spend. Combined with relaxed underwriting criteria for the subprime market, less budget-conscious consumers may find the ease of use too much to resist.

Kevin Morrison

Providers Need to Plan for Mobile Payments

Aite Group’s survey found that the most significant factor for consumers choosing a rewards or loyalty card is the annual fee.

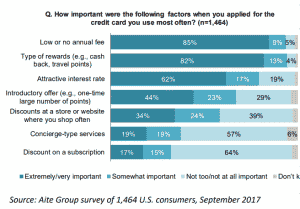

While the type of rewards earned is important, the most significant factor in choosing a rewards/loyalty card is the annual fee, based on the survey findings. Across all generations, the overwhelming majority say low or no annual fee and type of rewards are extremely or very important (85 percent and 82 percent, respectively). Interest rate also ranks highly, with 62 percent of respondents rating it extremely or very important. Introductory or bonus rewards point offers rank fourth, while benefits such as concierge services or subscription discounts are of least importance.

Based on the current rate of digital mobile payments adoption and the impact increased redemption rates will have on breakage revenue, providers should already be in strategic planning with their current and/or potential loyalty vendors to identify where they can best leverage their assets.

U.S. household credit card debt is now surpassing pre-recession levels. While default rates are still relatively low and economic growth remains strong, consumers will begin to whittle away the number of cards or apps they use, and the most ingrained card or mobile wallet and the best rewards program will be the ones left standing.

The digital environment promotes the ability to market, acquire new customers, extend credit and reward both application approval and spend in a matter of minutes. While this provides seamless, real-time convenience for the customer, it also introduces risk to the lender, the merchant and the consumer.

Kevin Morrison is a senior analyst on Aite Group’s retail banking and payments team. To learn more about Aite Group’s research coverage of retail banking and payments, please contact Aite Group at info@aitegroup.com.