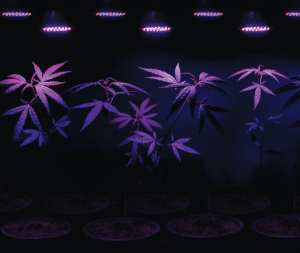

Marijuana plants being grown under blacklights to boost their potency. Massachusetts banks and credit unions continue to stand up services catering to the cannabis industry despite signs demand for recreational marijuana may be starting to slow. iStock photo

Despite some signs of slowing demand for recreational marijuana, Massachusetts’ banks and credit unions continue to enter this still-growing market. The draw: existing customers now serving the marijuana industry and perceptions of an underserved market for cannabis business lending.

Prices for marijuana products have fallen across the state, and last month brought news that a Massachusetts recreational marijuana store would shut down, a first. Yet by mid-December, sales for the state’s marijuana retailers had already exceeded the total sales for 2021, according to the state’s Cannabis Control Commission.

About a dozen banks and credit unions now provide cannabis banking services in Massachusetts, including Needham Bank, which acquired Century Bank’s long-time cannabis business from Eastern Bank last year.

Last year also saw Dedham Savings launch a cannabis banking program and Springfield-based Freedom Credit Union add the first dispensary to its new cannabis banking business.

“There is a set number of cannabis businesses, but they’re of all different kinds,” said Paul Dunford, co-founder and vice president at cannabis software company Green Check Verified. “We do still get inquiries from financial institutions in Massachusetts – I don’t think we’re at saturation in terms of banks and credit unions.”

About one-third of applicants for cultivator or product manufacturer licenses have received a final license as of mid-December, according to the Cannabis Control Commission, along with 57 percent of retail applicants. More than 600 applicants in just those three categories have yet to be fully licensed.

Industry Service Providers Need Banks

Freedom Credit Union decided in 2021 to launch a cannabis banking business after seeing other types of businesses – like electricians – looking to offer services to cannabis-related businesses. Given how relatively few institutions provide cannabis banking services, the credit union also saw an opportunity serve cannabis-related businesses, said Susan Crum, who joined Freedom Credit Union in 2021 as business development officer for cannabis business services.

In creating its program Crum, who previously worked at Connecticut-based core technology provider COCC and North Adams-based MountainOne Bank, spoke with business owners to develop a sustainable pricing model that would be affordable while still producing income for the credit union despite the program’s higher administrative costs. Crum said these businesses need the same types of banking services that any business would need.

“This is just banking,” Crum said. “It’s just a little bit higher level of compliance and due diligence.”

Some Massachusetts banks and credit unions set up cannabis banking operations after finding existing customers were beginning to serve the marijuana-related businesses.

Freedom Credit Union uses Shield Compliance as its software partner, which lets it monitor all of a customer’s financial activities.

“We monitor every single cent that goes in and account for it,” Crum said. “We have more transparency into their businesses than we do in any other business.”

The credit union, which has a field of membership that includes two Connecticut counties, also offers services there. Connecticut launched recreational retail sales earlier this month, and Freedom Credit Union recently brought on its first Connecticut-based business, a start-up involved with cultivation.

Dedham Savings got involved with cannabis in response to customer needs, said Laura Hickson, the bank’s vice president and Bank Secrecy Act and security officer. The bank had heard from customers looking to get involved with or invest in the cannabis industry, Hickson said, and began exploring cannabis banking.

“We want to accommodate our current customers,” Hickson said. “We want to stay current in the industry and not have these customers go elsewhere.”

LinkedIn a Useful Tool

Starting a cannabis banking business was, as the bank expected, a big project, Hickson said, noting that it touches nearly every area of the bank. Dedham Savings worked with Green Check Verified to develop the program and uses the company’s cannabis banking software.

While some financial institutions do not publicize their cannabis banking programs, Dedham Savings decided to make its program known. This included announcing their program through a press release, adding a link on its website’s homepage and using cannabis-related terms in its search engine marketing.

The bank also used social media, to a certain extent, to advertise its program.

“We did that very carefully,” said Liz Bissell, senior vice president of marketing at Dedham Savings Bank. “We chose to work on LinkedIn specifically, thinking that these are business owners and that LinkedIn might be a part of their normal day already.”

Bissell said the growing list of cannabis-related businesses in the region has made for plenty of banking opportunities.

“The challenge is always – with any business, whether it’s a cannabis business or otherwise – getting to the business owner when they first need their account, rather than them already having the account and us trying to convince them to switch to us,” Bissell said. “If we can find them when they are looking for the account, that is really what we want to do.”

Diane McLaughlin

Firms Not SBA-Eligible

Dedham Savings continues to develop its program based on customer needs, Bissell said, including offering debit cards, which can be used for items such as office supplies but not for cannabis-related products. The bank is also developing new cannabis lending products in response to customer needs, she added.

As cannabis banking continues to grow, offering loans will become an important service for financial institutions, said Green Check Verified’s Dunford, noting that these businesses are not eligible for U.S. Small Business Administration loans.

Dunford said banks and credit unions have started launching loan products to help business access capital, including to pay application fees or build out facilities. The business’ facility is often used as collateral, Dunford said, since the product itself cannot be used.

“There is still some hesitancy around lending because there aren’t established underwriting models,” Dunford said. “Every financial institution in a way kind of has to invent their own criteria, but they know that it’s necessary, so more and more of them are getting into it.”

|

|