Feeling a sense of mission to address racial disparities in business lending and home ownership, Massachusetts banks are turning to a little-used type of program first authorized nearly 50 years ago. iStock photo illustration

Massachusetts banks looking to level the playing field for prospective homeowners and business owners who have experienced discrimination in the past are starting to turn to an old, but rarely-used concept: special-purpose credit programs.

Eastern Bank now offers loans of up to $250,000 to woman- and minority-owned businesses who wouldn’t otherwise qualify for bank capital. And the biggest such program, run by the Federal Home Loan Bank of Boston, expanded this year but within a month saw its entire lending capacity spoken for by FHLB Boston’s member banks.

A special-purpose credit program, or SPCP, is a targeted lending products designed to specifically advantage an economically disadvantaged group of people. These programs are allowed through a 1976 update to the Equal Credit Opportunity Act that says a for-profit entity can have a program like an SPCP and it will not be discriminatory if it meets standards that are today set by the Consumer Financial Protection Bureau.

Words into Action

After a Minneapolis police officer murdered George Floyd in 2020, Federal Home Loan Bank of Boston Senior Vice President Kenneth Willis wanted to turn many bankers’ messaging into action.

“I began to look at what can the bank do in an area where it has expertise. After George Floyd was murdered, there were a lot of statements about equity, so I said, ‘Well, the one thing that I know the best is really about mortgage lending and homeownership,’” Willis said during a panel discussion on Special Purpose Credit Programs last month hosted by The Boston Foundation and the Partnership for Financial Equity.

Out of that was born the Lift Up Homeownership program. It awards funding to member banks on a first-come, first-served basis to provide people of color with incomes up to 120 percent of the area median income with up to $50,000 in down payment and closing cost assistance toward the purchase of their first home.

To date, the program has helped 50 homeowners with each taking $50,000 in down-payment assistance. Eighty-eight percent of these were African Americans.

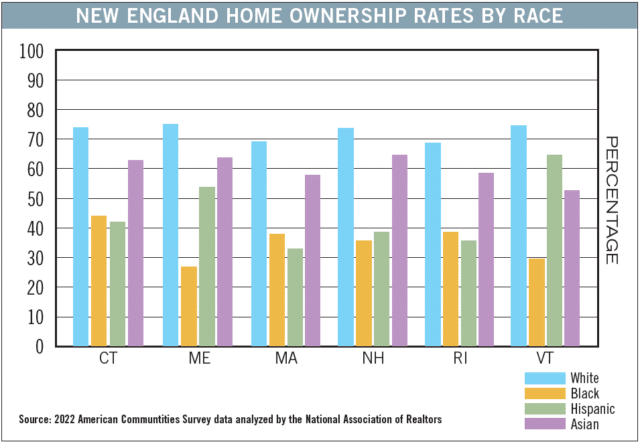

Graphic by Bill Samatis | Special to Banker & Tradesman

For this year’s iteration of the program, FHLB Boston expanded the program to $5 million, which member banks reserved in under a month.

In the process of creating the program, FHLB Boston worked with the Joint Center for Housing Studies at Harvard University to do a study on homeownership rates across New England. The findings showed 70 percent of white households in the region own their home while only 48 percent of households of color did. A nationwide study by the Joint Center for Housing showed that in Massachusetts, while the rate for white households remained around 70 percent (69.4 percent), only 37 percent of households of color owned their homes.

“So that is a significant gap, and we all know that what comes with the homeownership gap is a wealth gap,” Willis said. “Most people achieve wealth either by investing in a 401K, having a retirement or in your home, the equity that you build. If you don’t have homeownership, you don’t have that opportunity.”

FHLB Boston ended up focusing its program on individual borrowers instead of historically-disinvested minority neighborhoods because these studies showed it would make a greater impact than essentially telling people where they ought to live.

“Home ownership represents freedom,” Willis said. “Freedom, where you’re told you must live in a certain Census tract in order to get assistance, that just didn’t seem like the way to go. I think the other implication we were concerned about was concentration of poverty. We’re serving low to moderate income individuals, and again, you’re telling them that they all have to live within a certain Census tract.”

Cracking the Door Open

Eastern Bank also has a special-purpose credit program focused on minority and female-owned businesses. Applicants can use the program to access loans up to $250,000. Eastern has so far closed 10 loans through the program.

Steven Antonakes, executive vice president for enterprise risk management at Eastern Bank, told the Boston Foundation panel that while Eastern has done and continues to do ordinary small business lending, bank executives wanted to do more to help close the racial and gender gaps in business ownership and access to capital.

“We were the largest SBA lender in Massachusetts 15 years running, something we take a degree of pride in. However, it felt like that wasn’t sufficient enough to close the racial wealth gap and to provide greater access to capital, greater access to credit for women and business owners of color,” Antonakes said.

The result, he said, was a special-purpose credit program “that we designed internally with an eye towards folks who historically have not had access to credit or may not qualify for credit under traditional underwriter purposes.”

“We feel good about the program, and we didn’t do this for [Community Reinvestment Act] credit, but we presume we’ll get CRA credit,” Antonakes said.

Graphic by Bill Samatis | Special to Banker & Tradesman

Tough Conversations

With programs that are aimed at benefiting a specific race of people come difficult conversations. Even just talking about race itself can make for some tense discussions.

Willis admitted to his Boston Foundation audience that he had to have some blunt conversations with the board of the bank.

“Whenever you say the word ‘race-based’ it conjures up feelings of uneasiness, right? No one wants to talk about race. They get fearful, right? And so the first thing I have to do is have a really candid conversation with the chair of the board and the CEO,” he said.

But even after that, external criticism can arrive. Willis mentioned that he received multiple letters from legislators claiming that the SPCP was illegal.

The Supreme Court’s 2023 decision in Students for Fair Admissions v. Harvard, which overturned colleges’ affirmative action admissions programs, has raised concerns about how SPCP could potentially be targeted. But Zachary Best, a lawyer at civil rights firm Relman Colfax, said that, legally, this is not anything to worry about.

Willis said he spoke to regulators throughout the program’s creation. The conversations were positive, he said, and that regulators wanted to continue a dialog regarding SPCP and encouraged their depository and credit unions to participate them if they are in compliance with the requirements.

Eastern spoke with its regulators, too, but did so as a matter of informing them of the bank’s intentions, not looking for permission.

“We thought it was the appropriate thing to do: [Give] them the opportunity to provide feedback, explain what we were doing, what the goals of what we were doing and how we thought the steps we were taking would ensure compliance with the Equal Credit Opportunity Act,” Antonakes said. “We have a CRA exam upcoming. This will be the first time they probably do a deeper dive in the program. We feel really good about where we stand.”