Even with Greater Boston’s low inventory of homes for sale and high housing prices, first-time homebuyers still found ways into the housing market last year, including with the assistance of government-insured mortgages.

Loans offered through the Federal Housing Administration made up almost 10 percent of Massachusetts’ residential purchase mortgages in 2019, according to The Warren Group, publisher of Banker & Tradesman.

With lower down payment and credit requirements compared to other mortgages, FHA loans have been a key resource for first-time homebuyers. But during the economic crisis caused by the coronavirus pandemic, investors have raised their criteria for purchasing these loans on the secondary market, causing lenders to adjust their own underwriting standards.

“When those changes are being driven by investors, we then have to make changes internally to be able to match that up, so we can continue those partnerships,” said Robert Cashman, president and CEO of Metro Credit Union. “This is a great program, and we want to just make sure that we have the opportunity to keep it going.”

Buyers Have Options

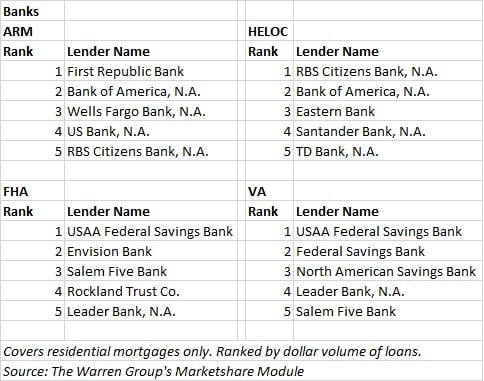

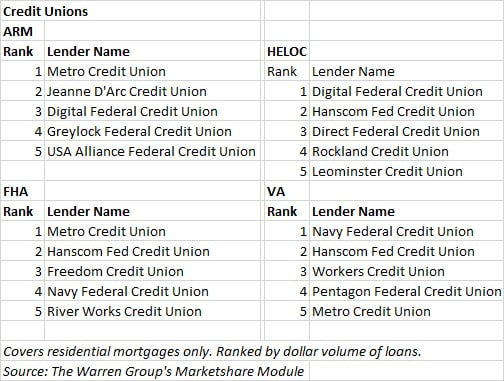

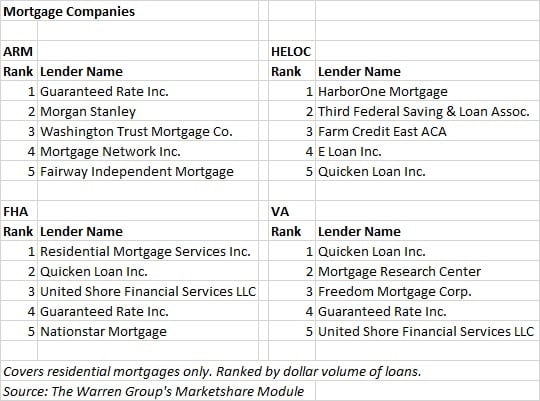

The Warren Group is reporting the top lenders for FHA loans, as well as Veterans Affairs loans, home equity lines of credit and adjustable–rate mortgages in Massachusetts. The rankings include banks, credit unions and mortgage companies and are based on loan volumes in 2019.

FHA loans are insured by the federal government and offer low- to moderate-income homebuyers lower down payment, debt-to-income and credit score requirements compared to conventional mortgages. The minimum down payment is 3.5 percent, and borrowers need a credit score of only 580. Those with credit scores between 500 and 579 are eligible for a loan–to–value ratio of 90 percent.

There are some downsides, including more costly mortgage insurance. The overall process can be more time–consuming than other mortgages, Cashman said, and involves additional paperwork.

First-time homebuyers in Massachusetts do have other options for mortgages. Both MassHousing and the Massachusetts Housing Partnership offer products, and MHP just partnered with Boston officials to expand its ONE Mortgage product for first-time homebuyers in the city.

The government-sponsored enterprises Fannie Mae and Freddie Mac also offers mortgages for first-time borrowers. But in its annual report to congress released this month, the Federal Housing Finance Agency, which regulates the GSEs, said it had started working with the FHA last year to address overlaps between GSE and FHA loans.

Investors have raised their criteria for purchasing FHA loans on the secondary market, causing lenders to adjust their own underwriting standards.

The FHFA said in its report that the agencies were addressing the overlaps because the GSEs and FHA “were created to perform different roles in our housing finance system.” The GSEs are now also preparing to exit the conservatorship that they’ve been under since being taken over by the federal government in 2008.

“Our approach is to focus each program on fulfilling its distinct mission, while ensuring the secondary market continues to provide liquidity and access to credit,” the FHFA said in its report. “In order to responsibly exit the conservatorships, the [GSEs] must not stretch to serve borrowers who are better served by FHA. This is critical to not repeating the mistakes of the 2008 crisis.”

Investor Demand a Concern

Last year, Massachusetts saw a total of $6.39 billion in FHA lending, including $2.73 billion in refinancing activity, more than double the refinancing activity from 2018. FHA purchase activity rose to $3.65 billion from $3.22 billion in 2018.

The top FHA lender for mortgage companies in Massachusetts in 2019 was Residential Mortgage Services, and the top bank FHA lender was USAA Federal Savings Bank.

Chelsea-based Metro Credit Union was the top FHA lender among credit unions. Cashman said the product ties well with the community, especially since it also had attractive interest rates.

“It really gives an opportunity for somebody who wouldn’t typically fit into a box of approval to get themselves into a situation where they could be able to get a mortgage,” Cashman said. “From a product point of view and finding a way to help out those in the community and our members, it really has been a great product.”

Due to the current crisis, Metro Credit Union has had to adjust underwriting standards to meet requirements of investors buying the loans on the secondary market. As the economy stabilizes and housing activity picks up, Cashman said, he is hoping that investors do not make more changes that will affect lenders and their ability to offer the product.

Diane McLauglin

Even during economic downturns, FHA loans can still perform well for investors, said Shant Banosian, a senior vice president at Guaranteed Rate, another top FHA lender.

He said he has seen some mortgage lenders stop offering both FHA as well as VA loans out of concerns that they do not perform well during unstable economic environments. Banosian said thoroughly reviewing borrowers from an income, credit and asset perspective can help ensure the quality of these loans.

“We’ve stayed very committed to VA and FHA loan programs because we feel like they’re important to serve clients that buy those types of loans,” Banosian said. “We’re committed to them, and we just felt like if we do a good job underwriting these files … that those loans would perform.”