Close to 1,000 multifamily units could be completed along Woburn's Commerce Way corridor in the next few years, reflecting developers' rising interest in sites near public transit.

Woburn’s commercial real estate market has benefited from proximity to Massachusetts’ busiest highway interchange at Routes I-93 and I-95, turning this former factory town into fertile territory for industrial parks, hotels and a robust retail trade.

Now as commercial and multifamily development starts to cluster around public transit instead of highways, Woburn officials are looking at rezoning a 236-acre district along Commerce Road for one of Greater Boston’s largest transit-oriented development experiments.

“This is part of a larger trend of retrofitting suburbia,” said Chris Kuschel, a senior regional planner for Metropolitan Area Planning Council. “People are waking up to the realization that transit is an asset and people want to live in walkable neighborhoods.”

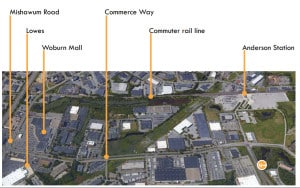

Bookended by the Anderson Regional Transportation Center and Mishawum Station on the MBTA commuter rail’s Lowell line, the Commerce Road corridor already is starting to transform. Two multifamily complexes totaling nearly 500 units are approved or under construction. And the new owners of the Woburn Mall are planning to build hundreds of apartments in a corner of the 20-acre property as part of a proposed Chapter 40R smart-growth district.

Nearly the size of Boston’s Back Bay neighborhood, the Commerce Road corridor is occupied primarily by industrial buildings, and 40 percent is covered by parking lots. That points to opportunities for denser, mixed-use development, Kuschel said.

Neighborhood ‘Screams out for Redevelopment’

The Metropolitan Area Planning Council has begun a study of the Commerce Way corridor, where 19th-century glue and chemical factories left a trail of pollution that resulted in a 245-acre Superfund site designation in 1983. Many of the properties have been redeveloped as warehouses and distribution centers.

Two experienced area developers already are moving ahead with apartment projects in the northern end of the district. Boston-based Cabot, Cabot & Forbes obtained approvals last year to build 289 apartments at the former Fitzgerald Tile property, about a seven-minute walk from the Anderson train and bus station. National Development broke ground in January on the 200-unit Emery Flats apartments in the nearby 1.3-million-square-foot MetroNorth Corporate Center.

The projects reflect a region-wide uptick in multifamily development near transit, according to research by Boston-based Perry Brokerage Assoc. There were 641 multifamily units built last year within a 10-minute walk of a MBTA commuter rail station, and nearly 1,800 units are scheduled for completion in both 2018 and 2019.

“There are a lot of industrial uses and low densities including parking lots within 10 minutes of the Anderson RTC,” said Brendan Carroll, Perry Brokerage’s director of intelligence. “In today’s climate, that screams out for redevelopment.”

With its 2,500 surface parking spaces, Anderson RTC offers its own opportunity to build housing and structured parking, MAPC’s Kuschel said. He compared the site’s potential to Riverside station in Newton, which the MBTA leased to Normandy Real Estate Partners for a mixed-use development including 290 residences.

The 26-acre Anderson property is owned by Massport, which has not signaled interest in redevelopment yet, Kuschel said. Massport did not respond to inquiries about the future of the property.

Developer Fast-Tracked Highway Connection

Improved highway access laid the groundwork in the late 1990s for the neighborhood’s commercial growth. Newton-based National Development paid for design work for a new ramp connecting Commerce Way to I-93 as it built out the 1.3-million-square-foot MetroNorth Corporate Center. The park includes the headquarters for Raytheon Corp.’s missile defense division, which recently renewed its lease for 440,000 square feet at 225 and 235 Presidential Way.

Originally conceived as a traditional office park, MetroNorth later added a Boston Sports Club and Residence Inn by Marriott. Apartment construction was a logical choice for the last parcel in the park still owned by National Development, said Doug Arsham, the firm’s vice president of development.

Meanwhile, Cabot, Cabot & Forbes obtained approvals from Woburn officials last year for its own 289-unit apartment complex on Commerce Way, in a redevelopment of the Fitzgerald Tile property. Many of the nearby industrial properties could follow suit if the city rezones for mixed-use projects, Arsham predicted.

“When you look at what’s important for the bones of good real estate in the market, it’s all there,” he said. “It’s pretty clear with the amount of square feet that can be developed in that area, it really has a lot of value for uses other than straight industrial or warehouses.”

Woburn Mall Eyed for 40R District

At the south end of the study area, South Carolina developer Edens Inc. is planning to add hundreds of multifamily units and update the 20-acre Woburn Mall property that it bought last year for $44 million.

The 42-year-old mall is approximately 60 percent occupied and anchored by Market Basket on a long-term lease. As it recruits new tenants, Edens is focusing on attracting more entertainment and restaurants, said Brad Dumont, managing director of Edens’ Northeast region. The retail footprint would shrink from over 270,000 square feet to approximately 230,000 square feet.

“We think it’s a dated concept that needs to be transformed. There needs to be a significant repositioning if we’re going to make it something special,” he said.

The proposed number of apartments will be determined following additional discussions with Woburn officials, Dumont said. Built in partnership with AvalonBay Communities, the housing would be located behind TJ Maxx on the northwest corner of the property near the flag stop Mishawum train station. The residential portion would be completed under a proposed Chapter 40R smart-growth district, which offers Massachusetts communities incentive payments of up to $600,000 for multifamily development near public transit.

“The site itself has a ton of traffic, but the make up of the existing mall is in need of some change,” said Michael Dalton, an executive director at Cushman & Wakefield. “What they’re going to do there is bring in a nice, creative mix of tenants.”

|

|