Are luxury condominium prices in Boston finally peaking? Or are they poised to take another big leap?

Beats me. But I’d much rather be Millennium Partners, with hundreds of millions in the bank from sales at its new Downtown Crossing tower, than Dick Friedman, who is still two years away from delivering his luxurious 61-story Four Seasons tower.

And I would much rather be Friedman, who may very well shatter condo price records in Boston when his new posh skyscraper finally opens, than any of the bevy of other developers either still in the city permitting process or just gearing up to start construction on deluxe new condo addresses, a category that until a few days ago also included Simon Property Group.

Simon’s decision to mothball its long-planned Copley Place condo tower has sent some minor tremors through the market, with luxury condo brokers working overtime to talk up just how Hot! Hot! Hot! the downtown Boston market still is.

Yet the big upscale mall developer’s decision has more to with the importance of getting the timing right in real estate – and being able to deftly maneuver through the tangled maze of neighborhood development politics in Boston – than any signs of an imminent fall of luxury condo prices.

After fiddling around for a decade, Simon was faced with a potentially risky bet of starting construction now and opening its new luxury condo and apartment tower in 2019, when luxury condo prices and rents may have peaked or even started falling.

Timing Is Everything

Jittery brokers aside, downtown Boston’s gold-plated luxury condo market is very strong and may well remain that

way, if not forever, then at least for a little while longer.

Long-time Boston developer Dick Friedman has lined up buyers for as many as half of the deluxe condos at his new Four Seasons sky-rise – one of the penthouses is said to be going for as much as $5,000 a square foot, or a lofty $40 million.

For its part, national luxury residential developer Millennium Partners has its fair share of big deals to brag about, having sold its showcase penthouse for $35 million. The developer is in the last phase of selling out the condos at its new Millennium Tower in Downtown Crossing.

The success both developers are seeing is due in no small measure to the extremely polished towers they are delivering as they push prices to Manhattan levels. But as importantly, both Friedman and Millennium have demonstrated a superb sense of timing when it comes to hitting the market.

Just look at how Millennium swooped in to take over the failing plan to build a new tower next door to the historic Filene’s building in Downtown Crossing.

The previous developer, John Hynes, left a gaping hole in the middle of Downtown Crossing after kicking off work just months before the financial markets crashed in 2008. By the time Millennium rode to the rescue four years later, it was able to write its own ticket, getting city approval for a tower which, at 60 stories, was much higher than Hynes’ old plan.

The economy and the real estate market were just starting to shake off the after effects of the Great Recession.

The new Millennium tower opened this July, four years later, to rave reviews. Four months late, just 19 out of 442 condos have yet to be sold in a downtown condo market shattering price records by the week.

Developer of the Charles Hotel in Cambridge and Boston’s Liberty Hotel, Friedman won the nod in 2013 to develop an iconic tower next to its historic Back Bay church and reflecting pool.

He broke ground two years later in 2015 and his crack sales team, led by Tracy Campion, the queen of the downtown Boston condo market, has already started to line up large numbers of buyers, even with the tower still two years out from opening.

While those two years represent a potential risk – after all there are no guarantees when it comes to the world economy – Friedman may very well nail down condo prices that are a step above even what the new Millennium Tower is seeing.

By contrast, timing has not exactly been Simon’s strong suit.

Despite being blessed with a Copley Square location that’s basically Main on Main in Boston, Simon has spent a decade spinning its wheels with no end in sight.

Let’s just take a little look at mall owner’s long and hapless pursuit of its Back Bay condo tower plans.

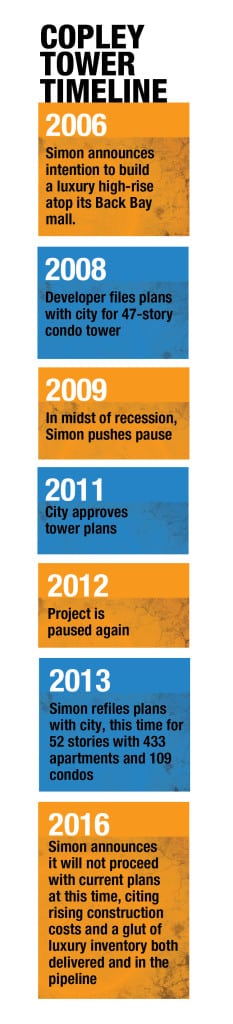

Simon first rolled out plans for a tower overlooking Copley Square in 2006, a good six years before Millennium took over the Filene’s redevelopment and seven years before Friedman snagged the development rights for his new tower.

Talk about blowing a lead!

Simon’s background building suburban malls shone through in the ham-handed way it struggled through the Boston approval process.

Simon spent two years exploring plans for a tower – and playing it cute as to what the height would be amid mounting distrust among Back Bay activists – before filing plans with the city in 2008 for a 47-story condo high-rise. Simon and its hired flaks then sparred with its neighborhood critics and Marty Walz, Back Bay’s state rep at the time, over concerns the new tower would cast deep shadows over Copley Square and Trinity Church, before putting the whole plan on the back burner after the recession.

The mall builder finally won a green light from City Hall for its Copley Place tower plan in 2011, only to mothball the project again the following year.

That proved to be a temporary retreat – Simon popped up again in 2013, and went back to city officials to rejigger its plans.

This time it would build a 52-story tower with 433 apartments and 109 condos, backtracking on previous plans for all condos.

That might have worked Simon had kicked off construction three years ago, but the luxury apartment market, unlike its condo cousin, is fast becoming overbuilt, a problem since rentals are now the project’s core offering.

Fast forward to 2016 and Simon is pulling its plans back again, citing a glut of luxury apartment high-rises in Boston and rising construction costs.

Yet far more shocking was Simon’s belief that it could build its new tower for $500 million.

Granted Simon controls the development rights, so it doesn’t have to buy the land, but that sounds very low in an age of billion-dollar projects and towers.

The only sure thing with Simon and its luxury residential dreams is that the mall builder will be back someday again with another plan, as it made clear in its latest pronouncement that it isn’t putting a permanent kibosh on its wayward tower plan.

Lucky us.

All of which is to say the luxury condo market could very well be nearing a peak.

But the collapse of Simon’s latest Copley Place tower plan, while a great example of atrocious market timing, doesn’t offer much insight on that big question.

|

|