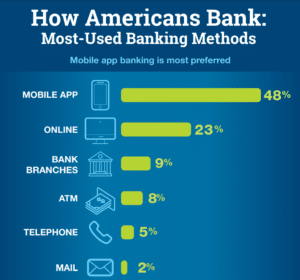

An infographic showing how much Americans use different types of technology for bank transactions. Image courtesy of the American Bankers Association

Two national studies show that US bank consumers are shifting their preferences more to digital banking platforms, both mobile and online, instead of opting to go to branches – particularly to branches inside big retailers.

The American Bankers Association recently released an online survey of 2,211 Americans that found most of respondents’ banking was done on their phones and other mobile devices (48 percent), and online via a laptop or desktop computer (23 percent) in the past 12 months.

The rest were transacting via branches (9 percent), ATMs (8 percent) and over the phone (5 percent).

The survey was conducted Sept. 20-22.

The survey also reported that the majority of all age groups now turn to mobile banking for their transactions. About 57 percent of Generation Z respondents and 60 percent of Millennial respondents used mobile banking in the past year, while 52 percent of Gen X respondents and 39 percent of Baby Boomer respondents had also adopted banking on their phones.

“Mobile banking use accelerated during the pandemic and has only grown in the years since as people continue to enjoy the convenience of banking on the go,” Brooke Ybarra, the ABA’s senior vice president of innovation strategy, said in a statement. “While digital channels are used most frequently, and people clearly appreciate having their bank as close as their mobile phone, consumers continue to have a wide array of banking options to meet their needs. For those who prefer to conduct transactions in person, branch visits remain a widely available option.”

The number of people who said they were transacting in a physical branch decreased with age. Only 4 percent of Gen Z and Millennial respondents said they conduct transactions inside a branch, while 9 percent of Gen X and 16 percent of Baby Boomer respondents said they still go in the lobby for their banking.

Meanwhile, S&P Global Market Intelligence reported that 10.7 percent of US banks closed their in-store branches, small bank branches inside big retailers such as grocery stores. In comparison, other types of branches only had a 1.4 percent closure rate as of June 30.

The report showed that big banks moved away from in-store branches, including Citizens Bank which closed 39 branches inside Stop & Shop supermarkets, five of them in Massachusetts.

Some banks experience a boost in deposits through online banking. For example, Cambridge Savings Bank’s digital-only Ivy Bank saw an acceleration in deposits which pushed the bank up to the list of top deposit holders in Massachusetts.

|

|