Business surveys in Massachusetts are delivering mixed reviews this week.

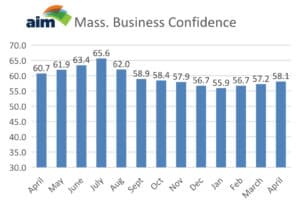

Associated Industries of Massachusetts reported Monday that employers grew more confident in April despite high inflation and the economic contraction in the first quarter. The trade group’s business confidence index posted its third straight monthly gain, rising to 58.1 on a 100-point scale.

“Massachusetts companies remain optimistic about the sustainability of the economic expansion even amid tightening financial conditions and uncertainties related to COVID-19 and the war in Ukraine,” Sara Johnson, chair of the AIM Board of Economic Advisors, said in a statement.

Johnson said every element of the business confidence index was in an optimistic territory in April, and the highest reading was recorded for employers’ views about the prospects of their own companies.

AIM analysts said Bay State businesses continue to be hampered by supply chain constraints and attributed price increases and material shortages locally at least in part to COVID lockdowns in China and Russia’s invasion of Ukraine.

“Companies are being forced to use every bit of creativity they can muster to secure the supply of raw materials and get their products into key markets,” said AIM President John Regan.

The view from small businesses nationwide, as reported Tuesday by the National Federation of Independent Businesses, is markedly different.

The NFIB Small Business Optimism Index, which samples sentiments of NFIB members monthly, was unchanged in April, and the number of small business owners expecting better business conditions over the next six months decreased to the lowest level recorded in the 48-year-old survey.

NFIB Massachusetts chief Chris Carlozzi said the small business outlook in Massachusetts is “very similar” to the outlook nationally. Small businesses, he said, continue to struggle to fill open positions and are spending more for labor and materials, which leads to higher prices.

“All across the board you’re hearing these struggles continue,” Carlozzi told the News Service on Wednesday.

While some larger employers barreled through the pandemic by switching to remote work, Carlozzi said NFIB members in the retail, hospitality and services sectors were among those that were shut down completely during the pandemic and have struggled since to bring back workers. Many smaller businesses don’t have the same purchasing power as their larger counterparts, he said, and some have been forced to pivot to entirely new models of operation.

Carlozzi urged lawmakers to adopt unemployment insurance policies that would provide more relief to small businesses, avoid new “labor mandates,” and pass estate tax reforms that he said would make Massachusetts more competitive with other states. Gas tax relief, he said, would also help businesses that need to deliver their products and can’t escape record-high inflation and gas prices. Massachusetts lawmakers have so far rejected gas tax suspension plans.

The U.S. Bureau of Labor Statistics on Wednesday reported that inflation remains at extremely elevated levels, increasing 8.3 percent for the 12 months ending April, compared to the 8.5 percent increase for the 12-month period ending in March.

As he unveiled a $49.7 billion fiscal 2023 budget bill on Tuesday, Senate budget chief Michael Rodrigues flagged supply chains problems, the situation in Ukraine and “mounting inflation” as among the factors contributing to “increasing economic anxiety, turbulence and uncertainty at home.”

But Rodrigues said Massachusetts has shown “economic resilience” and described a state ready to meet future needs due to in part to the work of its taxpayers, who have helped post record budget surpluses and build the state’s rainy day fund to $4.6 billion, with a $6.7 billion balance in the forecast.

|

|