When lawmakers approved changes to the nation’s tax laws late last year, many banks moved quickly to invest in their workforce, offering bonuses and increasing the minimum wage. But as 2017 proxy reports detailing executive compensation emerge, banks do not appear to have adjusted executive compensation with the same haste.

“We are not seeing changes designed immediately because lots happened very late in the year,” said Susan O’Donnell, partner at Newton-based Meridian Compensation Partners, which specializes in executive compensation. “But [tax reform] could have an impact going forward.”

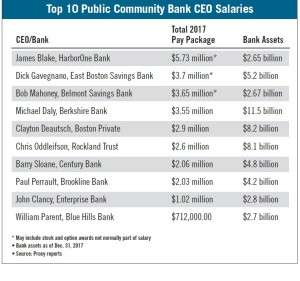

Most community bank CEOs in Massachusetts saw marginal increases in their salary last year largely due to an overall good performance by the bank, according to a review by of proxy reports at the 10 largest publicly traded community banks in the state.

But some CEOs, primarily the ones at the top this year, did see some larger increases because of large stock and option awards, which are distributed differently at different banks. Some CEOs seem to get them every year in smaller amounts, while others get larger sums sporadically. HarborOne Bank President and CEO James Blake led the way with a salary package of $5.73 million, but it appeared to be an abnormal year for him due to his stock and option awards – his salary is normally around $1.3 million. East Boston Savings Bank President and CEO Richard Gavegnano and Belmont Savings Bank President and CEO Robert Mahoney received $3.67 million and $3.65 million respectively, also due to large stock and option awards.

After that, Berkshire Bank President and CEO Michael Daly had the highest salary package in 2017 at about $3.55 million, more than $1 million higher than last year. Daly’s salary, however, had been expected to jump because Berkshire Bank’s parent company grew by more than $2.4 billion in assets between the end of 2016 and the end of 2017, fueled by the company’s acquisition of Commerce Bank in 2017.

Boston Private President and CEO Clayton Deutsch also saw a $450,000 jump between 2016 and 2017, reaching nearly $3 million, mostly from an increase in his non-equity incentive plan compensation.

Changes in 2018

Changes in 2018

One immediate impact of the tax overhaul on executive compensation is the elimination of a rule under the Internal Revenue Service that allowed executives to deduct performance-based payments over $1 million. Because of this provision, many companies would keep an executive’s base pay low and put more of their pay package into the performance-based category.

“Committees and companies were mindful about trying to reap benefits of this rule,” said Kristine Oliver, managing director in the Boston office of Pearl Meyer, another company that specializes in executive compensation. “Tax reform has gotten rid of that. This is an area with the potential to have an effect on compensation, but it will probably take a little to kick in.”

Under the old rule companies could only adjust the performance-based compensation downward, say if an executive didn’t hit their goals, Oliver said; now companies could potentially choose to adjust performance-based pay upwards.

Furthermore, this could shift the way executive compensation committees divvy out a CEO’s pay – executives in the future might get a higher base pay, but also be held to a higher standard in terms of performance-based pay, she said.

Another big change related to executive compensation was that banks of a certain size had to calculate and make public a pay ratio, which is a provision of Dodd-Frank that only just went into effect for the 2017 reports. The pay ratio represents the difference between the annual total compensation of a CEO and the median salary at a company.

Berkshire Bank had the highest pay ratio of 65 to 1, while companies like Rockland Trust’s parent company reported a 40 to 1 ratio.

But the pay ratio is likely a poor indicator upon which to judge a company, O’Donnell said.

Bram Berkowitz

“Part of the concern is they could be misinterpreted,” she said. “The numbers don’t tell us anything that is very helpful.”

The regulations allow considerable flexibility in pay ratio calculations, she said; some companies might include health benefits in the calculations, while others don’t.

In another example, a retail company CEO could have a pay ratio of 1,000 to 1, but that company might have included part-time or seasonal workers in its calculation, she said.

Tax reform and pay ratio aside, most banks enjoyed a healthy year, which in turn translated into healthy salary increases for CEOs.

“2017 was a better year in general than 2016,” said O’Donnell. “We looked at early filers in the banking industry and most [the CEOs] were paid at or above target.”