Instead of accelerating as high interest rates keep buyers on the sidelines, inventory is up only modestly in Massachusetts year-over-year.

Massachusetts’ housing market measurably cooling, but inventory is not rocketing upwards. The causes, experts say, are complex.

And rather than seeing price drops as one might expect in an economy dancing on the edge of a recession, the forecast is for only a continued slowdown in price growth.

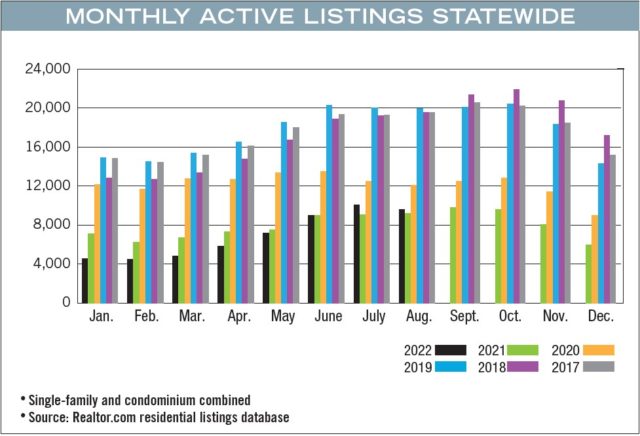

The number of active single-family and condominium listings, combined, had been rising faster than the year before for most of the spring and early summer, according to data from Realtor.com data sourced from MLS services. The total number of listings drew even with 2021’s monthly tallies in June. By the end of July, there were 10.64 percent more homes for sale in Massachusetts than there were in July 2021 as more and more buyers drew back from the market.

But then a strange thing happened. The spread between the two years shrank in August, to only 3.88 percent while the number of new listings hitting the market fell an uncharacteristic 22.15 percent year-over-year. Only 9,567 active condo and single-family listings were on the market in August, according to Realtor.com data, compared to 9,210 in August 2021 and 19,991 in August 2019.

“Sellers’ motivations are really diverse right now,” said Jody Kahn, senior vice president for research at John Burns Real Estate Consulting.

![]() Market Comes Down from a High

Market Comes Down from a High

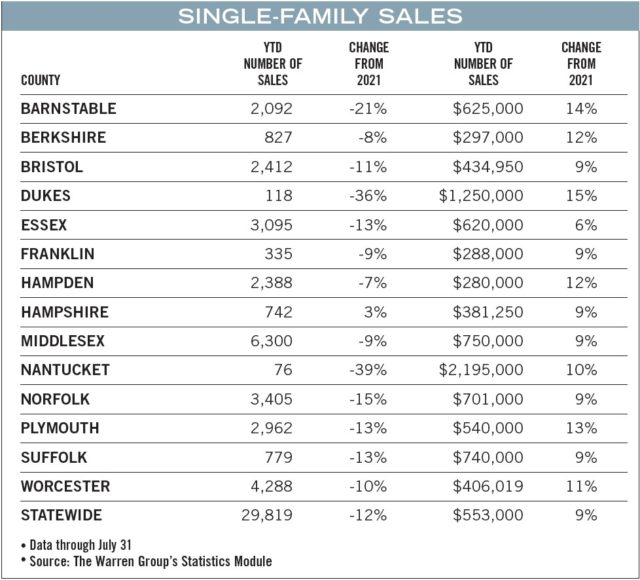

With Massachusetts home prices as high as they are – the monthly median single-family sale price registered at $585,000 in July while its condo counterpart struck $521,000 according to The Warren Group, publisher of Banker & Tradesman – the market is “really sensitive” to interest rate increases said Taylor Marr, deputy chief economist at brokerage and listings portal Redfin.

“If interest rates rise, [people] have to think about what they can afford,” Marr said. “It’s less enticing to buy.”

As the average interest rate on a 30-year, fixed-rate mortgage rose from 3.99 percent in January, to 4.99 percent at the start of August and 5.66 percent at the end of August, according to Freddie Mac.

Combined with rising prices, the jump in interest rates has been pushing more and more buyers out of the market all year, leaving increasing numbers of homes unsold each month.

“People’s expectations are being reset,” said Dawn Ruffini, 2022 president of the Massachusetts Association of Realtors. “Buyers are being a little more level-headed in their behavior. Sellers are getting a little bit of a reeducation that you can’t just put a sign in the yard and get a hundred offers.”

Price growth has begun to moderate. July’s median single-family sale price was up 8.33 percent year-over-year according to The Warren Group, compared to 17.39 percent year-over-year growth in July 2021.

Realtor.com data shows the share of Greater Boston listings with a price cut surged above 38 percent in June, and remained above 30 percent in July and August, as well. Year-over-year, the share of listings with a price cut has gone up each month since May, a phenomenon nearly unheard of since mid-2019.

Buyers as Sellers

With this July’s median single-family sale price 37.65 percent above 2019’s, and the median condo sale price 33.59 percent up, sellers are hardly hurting.

“The reason prices haven’t started going down faster in my opinion is because still, more than 50 percent of the buyers out there are also sellers, so they feel less of an impact” when they buy their next home, said Stacey Alcorn, founder and CEO of Dracut-based LAER Realty Partners. “There are still bidding wars on some properties. It’s just not the same thing we saw six months ago.”

Downsizers, too, are doing well, Ruffini said.

“If they can pull a lot of cash out of their home, they are very competitive on the market, as long as they can find a place,” she said.

Despite this, not a few would-be sellers are staying put.

FOMO No More

FOMO No More

On the Cape, some sellers are still worried about finding a new home and feel safer sitting tight – a worry some Massachusetts brokerages have tried to address with power buyer-like programs that arm sellers with financing and other tools to buy their new home without making the deal contingent on selling their current abode.

“What we’re seeing is sellers have found the property that have found the property they really want, and they’re willing to wait until it pops up to sell” their current home, said Cape Cod & Islands Association of Realtors CEO Ryan Castle.

The long run of record-low mortgage rates that powered the frenetic pandemic homebuying and mortgage refinance markets could be playing a role, too, Marr said.

John Burns Real Estate Consulting estimates that 73 percent of homeowners nationwide have a mortgage rate below 4 percent. Combined with clear market signals most homeowners can see in the world around them – an increased number of “for sale” signs in their neighborhood, news stories about a cooling housing market – it could be inducing some sellers to stay put if they don’t have to move right away, Kahn, with John Burns, said.

“I think the consumer can detect we’re past the peak pricing in the market,” she said, adding that many also are suffering from less fear of missing out on a historic opportunity.

James Sanna

Ladle in the economic uncertainty of the moment, and sellers have a wide range of reasons to stay put if they’re not in the throes of a major life event.

“Are you going to gamble on a new home, with a potentially higher monthly payments when it seems like we’re on the verge of a recession?” Kahn said.

Boston’s housing market seems to be faring somewhat better than its other high-cost, coastal peers, Marr said, but it’s still following the national trend.

“Our outlook is that price growth is going to continue to slow. We’re not seeing signs otherwise,” he said.