StonehamBank won top honors from the New England Financial Marketing Association for an online pop-up event that invited customers to take a virtual tour of Italy’s scenic Tuscany region during the depths of last winter and the height of a surge in COVID-19 cases. Image courtesy of Pannos Marketing

While Central Italy might not have an obvious connection to Massachusetts community banking, one Stoneham-based bank found a way to use a virtual tour of Tuscany to engage consumers during a surge in the pandemic – and came away with an award-winning marketing campaign.

StonehamBank and its third-party marketing firm, Pannos Marketing, won first place in the “out-of-the-box” category in the New England Financial Marketing Association’s annual contest open to banks, credit unions and financial services companies in New England.

Unlike past in-person pop-up events offered by StonehamBank, this campaign’s goal was not to sign up new checking account customers, said Lauren Constantine, the bank’s vice president and director of marketing.

Partnering with a well-known historian and an Italian restaurant, StonehamBank instead hosted a Zoom event that played on the fatigue many felt a year into the pandemic.

“We were providing escape to the community at that moment of time when they needed it,” Constantine said. “We were more than just a bank; we were outside the box. We were considering ourselves as StonehamBank – a community partner that could offer more than products and services but an actual experience.”

This approach to marketing could benefit community financial institutions with limited marketing budgets and provide opportunities to differentiate themselves in the market, said Jim Pannos, president of Pannos Marketing.

“Banks are notoriously risk averse,” said Pannos, who worked with StonehamBank on the campaign. “Not that this was a risk, but we needed it to stand out, and I think this holds true for community banks going forward – it’s all about differentiation, because the competition is everywhere.”

‘Great PR’ from Doing Good

‘Great PR’ from Doing Good

The $684 million-asset StonehamBank has two branches in Stoneham and Billerica, but its lack of a brick-and-mortar presence in surrounding towns presents some marketing challenges, said Pannos, whose firm works mostly with community-sized financial institutions in the U.S.

Finding a way to differentiate itself in today’s crowded market was also key, Pannos said, especially given competition from fintechs and big banks with larger marketing budgets.

Pannos Marketing has worked with StonehamBank for more than a decade. Before the pandemic, the two companies held pop-up events at various community gatherings, using social media to encourage people to visit bank representatives at the events and building the bank’s visibility, Pannos said.

But when the pandemic began in 2020, StonehamBank did not want to lose this momentum in raising the bank’s brand awareness, Constantine said, while at the same time recognizing the significant effects the pandemic was having on small firms. The bank decided to hold virtual pop-up events instead that helped drive sales at local businesses.

“We were helping to build camaraderie with the employees there, with small businesses; they were talking about it on social media,” Constantine said. “The community was talking about it on social media, about how the bank stepped up, so it was really great PR for the bank, but also we were helping a small business.”

Existing Customers Contacted

When StonehamBank and Pannos Marketing began working on the virtual Tuscany tour in January 2021, they wanted to pull the event together quickly to reach people affected by that winter’s surge in COVID-19 cases.

The bank partnered with art and architecture historian Rocky Ruggiero to lead the virtual tour of Tuscany, and advertised the event using social media, as well as an email blast to existing customers.

Social media and digital marketing are critical tools for community financial institutions, Pannos said, and their significance will likely continue to increase. Some banks are even using TikTok for marketing, and Pannos pointed to the impact the video-based social media app now has in influencing purchases.

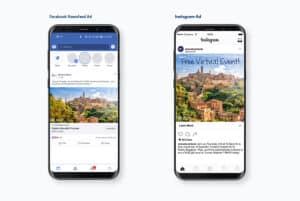

StonehamBank’s Tuscany tour campaign used Instagram and Facebook, with ads placed in feeds and stories. During the two weeks when the campaign ran in late January and early February, StonehamBank had over 70,000 impressions, 1,200 ad clicks, and 673 visits to the campaign’s landing page.

The email blast to existing customers saw 25 percent of recipients open the email, with a 3.5 percent click-through-rate. The bank had 155 total RSVPs, and more than 90 people attended the event.

Diane McLaughlin

Pannos credits Constantine for her willingness to take different approaches when marketing StonehamBank.

“With the out-of-the-box campaign, we were we were given the opportunity to be different and we took that and ran with it,” Pannos said. “It’s all about differentiation and making people notice you and be memorable.”

Using a third-party firm, especially one that the bank has worked with for a long time, elevated the bank’s approach to marketing, Constantine said.

“We’re small here at StonehamBank, so having a partner like Pannos Marketing with such experience and expertise in the marketing and advertising field, we feel confident enough when we have to work really fast, especially during COVID and unique situations, that we had a partner to help us guide us through it,” Constantine said.