A Navigator for Life’s Financial Storms

Inflation is still up and economic anxiety is rising – as is the need Allen Amadin sees for the types of help Auburndale-based American Consumer Credit Counseling provides.

Inflation is still up and economic anxiety is rising – as is the need Allen Amadin sees for the types of help Auburndale-based American Consumer Credit Counseling provides.

With the failure of First Republic Bank coming weeks after March’s unexpected bank failures, the banking industry will likely continue to see short- and long-term effects from the turmoil, local executives say.

Following criticism that KeyBank has not improved lending to Black homeowners and homebuyers, the bank’s parent company has commissioned a racial equity audit.

Amesbury-based BankProv saw deposits increase 9 percent during the first quarter, with much of that increase tied to its banking-as-a-service products and considered volatile by the bank.

JPMorgan Chase still wants to retain much of the wealth management business it acquired following First Republic Bank’s failure.

Prior to its failure and sale to JPMorgan Chase early Monday morning, First Republic Bank had been among Massachusetts’ top residential mortgage lenders.

Eastern Bank planned to pay off borrowings after selling about 25 percent of its securities portfolio at a loss, but the bank failures just days later changed those plans.

Eastern Bank had a first quarter net loss of $194.1 million after selling a portion of its securities portfolio for a loss.

HarborOne reduced staff in its mortgage division during the first quarter and plans to make other cost saving moves this year.

Cambridge Trust Co. saw deposits drop by 3.3 percent in the first quarter, with most of the outflows occurring before the bank failures in March.

The bank filed plans last week with the Office of the Comptroller of the Currency to close 16 more branches, mostly in the Greater Boston area.

Connecticut-based Webster Bank saw deposits increase by 2.3 percent during the first quarter.

Rockland Trust saw deposits drop by 3.8 percent during the first quarter even as the bank added new customers during the quarter.

The Washington Trust Co. is known as the oldest community bank in the United States, but no woman has ever held the title of president and COO of the bank until Mary Noons steps into the role this week.

While the banking crisis has raised questions about whether the FDIC should guarantee higher deposit balances, some banks have already found ways to insure their customers’ deposits: the IntraFi Network and similar fintech solutions.

Berkshire Bank saw deposits drop by 2.5 percent during the first quarter, but some of those lost deposits moved to money market products in the bank’s wealth management division.

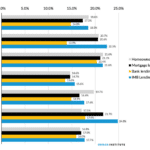

Even though the Community Reinvestment Act does not apply to independent mortgage banks, these nonbank lenders provide a higher share of their mortgages in minority and low- and moderate-income neighborhoods than banks do, according to a new report from the Urban Institute.

Buffalo-based M&T Bank saw deposits decline during the first quarter, a shift the bank expects to stabilize in the coming quarters.

As JPMorgan Chase continues its expansion in New England, the global bank has also expanded its reach with multinational companies operating in the region.