Enterprise Bank Plans Branch in Lexington

Lowell-based Enterprise Bank plans to open a new branch in Lexington.

Lowell-based Enterprise Bank plans to open a new branch in Lexington.

The top two Democrats on Beacon Hill and Gov. Charlie Baker said early Tuesday evening that they had agreed to seek a three-month delay to the start of a payroll tax to fund paid family and medical leave benefits for all Massachusetts workers, and would look to “clarify” the program’s details.

A Charlestown man was sentenced earlier this week in federal court in Boston for bank robbery.

The parent company of Amesbury-based Provident Bank is planning to raise up to about $252 million in a new stock offering that will make the company fully public.

After more than five decades in banking, South Shore Bank President Paul Pecci will retire at the end of the month.

City leaders, community figures and representatives of affordable housing developer Trinity Financial gathered over the weekend in Dorchester’s Ashmont Square to celebrate the opening of Trinity’s Treadmark building two years after a fire destroyed its first iteration weeks before completion.

The former CEO and co-founder of a Boston-based mobile phone music streaming service was charged with wire fraud in connection with a scheme to embezzle hundreds of thousands of dollars from his employer.

Members of the real estate, building and banking industries are always on the move. See who’s been hired and promoted in this week’s Personnel File.

While online services are becoming a core component of any bank’s offering, smaller, community-focused branches have a place in any expansion strategy.

Ronald McLean was hired earlier this year as president and CEO of the Cooperative Credit Union Association, a trade group that represents credit unions in Massachusetts, Rhode Island, New Hampshire and Delaware.

Boston Private CEO Anthony DeChellis has unveiled an aggressive expansion plan that would see the bank triple its assets under management in its wealth management and trust division from roughly $16 billion now to about $50 billion by 2022 and grow the actual size of the bank grow from a roughly $8.4 billion in assets under management to $11.2 billion.

A new analysis by the U.S. Chamber of Commerce finds the Trump administration’s plan to impose a 5 percent tariff on all goods from Mexico starting on June 10 could cost Massachusetts over $170.11 million.

Credit quality in Massachusetts ranked about average compared to the rest of the country.

House, Senate and Baker administration officials are still actively discussing whether they could agree to delay the rollout of the paid family and medical leave law for three months beyond July 1 without passing a bill this week, according to sources familiar with the negotiations.

Members of the banking and real estate industries gave back to their communities in many ways in recent weeks, including helping build a house for a needy family.

Santander Securities LLC will pay $100,000 and reimburse clients to resolve allegations of deceptive marketing practices relating to the sale of unsuitable variable annuity products to Massachusetts seniors following an investigation by Attorney General Maura Healey.

Amesbury-based Provident Bank is going fully public with a second-step conversion, the second by a Massachusetts bank this year following HarborOne in March.

For the second time in seven days, an office tower broke ground in the Seaport as Gov. Charlie Baker and Mayor Marty Walsh joined leaders from the Massachusetts Mutual Life Insurance Co. to celebrate the start of construction at 10 Fan Pier Blvd.

Boston Police arrested an armed robbery suspect earlier this week after the suspect masqueraded as a victim and asked officers for a ride to Logan Airport.

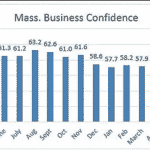

Massachusetts employers were less confident about economic conditions in May, amid renewed trade tensions and concerns among companies about increased operating costs from paid family leave and other government mandates.