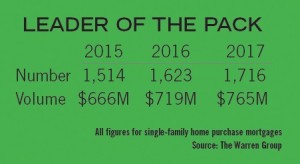

Arlington-based Leader Bank has long been a powerhouse in the residential mortgage market, so it should come as no surprise that they once again sat atop Banker & Tradesman’s annual list of top single-family lenders in 2017.

But the bank also managed another impressive feat: It increased total transactions and total volume during a year when many industry experts and data would suggest that housing inventory is at an all-time low.

Leader Bank originated 1,716 single-family mortgages for a total volume of roughly $765.4 million in 2017, according to analysis from The Warren Group, publisher of Banker & Tradesman. That’s over 90 more mortgages and $45 million higher than in 2016.

In comparison to 2015, the bank, which is mostly based in the Greater Boston area, originated 200 more loans and did almost $100 million higher in total volume in 2017.

“It’s just kind of heads down, plugging away. I wish I had a magic formula, but there isn’t one really. A lot of it is just maintaining really high-performing loan officers who drive business,” Jay Tuli, executive vice president who oversees residential lending at Leader Bank, told Banker & Tradesman. “We are also keeping rates as low as possible … We are pricing loans very competitive because we try to keep overhead as low as possible. We are very careful about bringing on unnecessary expenses.”

Meanwhile, data from the Massachusetts Association of Realtors, which records how many homes are listed in the commonwealth on the last day of each month, indicates inventory is at its lowest level in three years.

The lowest recorded inventory between January 2015 and November 2016 was 16,768 listings in February 2016. But between December 2016 all the way through 2017, inventory only rose above that number twice, in June and July of 2017.

Bram Berkowitz

On the last day of December in 2017, the Massachusetts Association of Realtors recorded 10,661 homes for sale, the lowest by far in the last three years. While the end of the year is always the lowest in terms of inventory, that number is 3,000 listings down from December 2016.

Leader Bank is not the only bank to buck the trend. Large banks like Santander and RBS Citizens were also able to increase total residential loans and volume, according to The Warren Group. But other prominent residential mortgage lenders in the state, including Wells Fargo and Berkshire Bank, saw total residential loans and volume decline year-over-year.

Adapting to the Market

Part of Leader Bank’s success can be attributed to its reputation and strong ability to move with the market.

“They have the ability to see what is happening with a specific buyer looking for a loan and customize a program or find a lender to customize a program,” said Steve McKenna, a Realtor at Arlington-based Bowes Real Estate. “Their interest rates have been very competitive over the years. For me in the industry, when you know that Leader is going to handle the loan, the chance of them closing it is very high. It attracts us to want to work with them.”

Tuli said with rising home values, there has been a big migration from conforming loans to jumbo loans in communities just outside Boston.

Leader Bank did roughly $196.4 million in single-family jumbo mortgages in the Essex, Middlesex, Norfolk, Plymouth and Suffolk counties in 2017, an increase of about $14 million from 2016, according to The Warren Group.

Total residential jumbo loan volume in those same counties grew from about $253.2 million in 2016 to almost $298 million at the end of 2017, according to The Warren Group.

Technology is also playing a role in helping Leader Bank close mortgages faster.

Tuli said a lot of energy has gone into updating the tech at the bank including the addition of a mobile app for the bank’s loan officers, an updated website and a new marketing platform.

Tuli said a lot of energy has gone into updating the tech at the bank including the addition of a mobile app for the bank’s loan officers, an updated website and a new marketing platform.

Additionally, Leader Bank has taken advantages of rule changes made by Fannie Mae last year to launch an initiative called Xpedite, in which the bank automates the verification of income for certain customers, and in some cases appraisal waivers as well.

Tuli said the result has been a 12-day reduction in closing times for those customers.

“A limited supply and lots of demand and a lot of buyers making cash offers are finding closings that are quick because there is so much competition,” he said. “We are reacting to what the market needs.”