Boston’s growing commercial real estate prices and declining interest rates have encouraged commercial property owners to refinance loans taken out in 2017 and 2018, and created opportunities for lenders to strike up new relationships.

Just as low interest rates have spurred the mass–refinancing of residential mortgages, commercial property owners have also taken advantage of the rate environment, creating opportunities for lenders in Greater Boston’s competitive market.

“There are opportunities for us to get new clients and maintain the ones we have,” said Rick Muraida, Rockland Trust’s senior vice president and head of commercial lending for Greater Boston. “That’s also a challenge because we’re probably in one of the most competitive markets in the country.”

Commercial real estate provides a limited but sought–after business for local banks, offering opportunities to establish relationships with profitable, repeat customers while helping banks obtain the type of loans they want to keep on their balance sheets.

Competitive Market

Low interest rates are not the only factor driving commercial refinancing. High property values have also played a role, said Brian Bullock, chief commercial lending officer and executive vice president at Enterprise Bank in Lowell.

Rising property values have contributed to building sales in the Greater Boston area, and new owners often look to refinance existing loans on their acquisitions. In some cases, Enterprise Bank has been able to use these inquiries to establish banking relationships with buildings’ new owners.

Those who hold onto buildings have also taken advantage of high property values as well through cash-out refinancing, using the funds for other business opportunities.

“We’re not necessarily looking to do a one-off refinancing of a building. If we can develop a relationship with the property owner, that’s what we’re focused on.”

— Brian Bullock, chief commercial lending officer and executive vice president, Enterprise Bank

Strong occupancy levels and rental rates make for good conditions for property owners, Bullock said, but adding that banks still need to be sure their clients do not take on excessive debt.

“You don’t want to overleverage the property too much,” Bullock said. “Because in a down economy it could pose a challenge.”

Overall Strategy

Overall Strategy

Banks face tight competition in the commercial lending space and look for more than just opportunities to refinance a loan.

“We’re not necessarily looking to do a one-off refinancing of a building,” Bullock said. “If we can develop a relationship with the property owner, that’s what we’re focused on.”

Borrowers do not look only for the best rate when considering refinancing, said Muraida, the lender with Rockland Trust. The terms and conditions of the loan are also often priorities for property owners.

“We take the time to really understand what the strategy for the asset is and make sure it’s for our mutual best interest,” Muraida said.

Muraida said Rockland Trust looks at clients’ short- and long-term strategies, maintaining a relationship with the borrower through the life of the loan. Borrowers choose banks like Rockland Trust for commercial lending, Muraida said, with an eye towards this kind of accessibility.

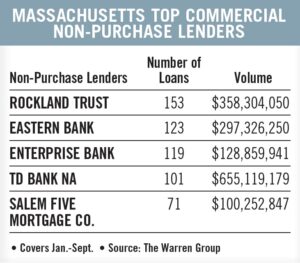

Rockland Trust, Eastern Bank and Enterprise Bank were the top three lenders for commercial refinancings in Massachusetts from January through September based on the number of loans, according to The Warren Group, publisher of Banker & Tradesman.

Refinancing Alternative

For both lenders and borrowers, refinancing is not necessarily a simple or inexpensive transaction.

Many commercial property owners who refinanced in recent months took out loans when rates increased in late 2017 and 2018, said Carl Taber, executive vice president and chief lending officer at BayCoast Bank in Swansea. He said older loans might be expensive to refinance, with lenders requiring a new appraisal, which could cost thousands of dollars.

Penalties from the original lender, attorney fees and closings costs are additional costs borrowers might face.

Diane McLauglin

For some property owners, a sizable drop in interest rates would be needed to recoup the cost of refinancing, Taber said.

One step banks may take as an alternative to refinancing a loan is modifying the loan documents, Taber said.

This is often easier for banks, since processing a loan requires time and staff resources, Taber said, adding that bank staff should be focusing their attention on new business.

“It’s sort of a win–win for the borrower and the lender,” Taber said. “If you don’t do it, you run the risk of the borrower going somewhere else to refinance.”