Local bank executives say high technology costs are an important part of what’s driving their peers to merge, but for others the spending is the price to pay for independence. iStock illustration

Concentrated corporate pricing power isn’t just lurking in consumer inflation.

Massachusetts banks and credit unions’ spending shows smaller financial institutions are disproportionately affected when it comes to rising technology costs.

These smaller institutions say a lack of competition among core providers is largely to blame, and it’s part of what’s driving some to merge with peers or sell themselves to larger entities.

When looking for core service providers, institutions essentially have three options: Jack Henry, Fiserv and FIS. A 2024 report by the Federal Reserve Bank of Kansas City found they collectively control 72 percent of the bank market and 45 percent of the credit union market.

“One thing that I think is absolutely important is that we need to kind of maintain an environment of competitiveness in the core space,” said Webster Five COO/CIO Kate Gallo Megraw, who also sits on the American Bankers Association’s core platforms committee. “So, if you’re on Fiserv, FIS or Jack Henry, those expenses kind of are what they are. There are some more niche cores, smaller cores that we are seeing banks go to, and the technology is great. It’s exciting.”

Alternatives Slow to Catch On

Alternatives are being developed, such as cloud-based options, but many banks are reluctant to sign on with other, lesser-known names. Among Massachusetts lenders, Holyoke-based PeoplesBank recently converted to Nymbus’ cloud-based platform – something CEO Tom Senecal described in a September interview with Banker & Tradesman as “a career-threatening move if it didn’t go so well.”

“There’s certainly next-gen core banking suites that are emerging in the marketplace. I don’t know many folks that have taken that step, but I know I’ve been looking at them for years and years,” said BrightBridge Credit Union Chief Digital Officer Stephen Lynch. “They haven’t become prevalent in the marketplace now, but I think a lot of financial institutions are looking very hard at where they are and when’s the appropriate time to consider adopting something like that.”

Core providers offer everything from the basic technology banks need to operate to software like loan origination systems and tools to integrate fintech products. At its most basic, Lynch said, the new generation of core providers is trying to use APIs and other tools to create more efficient, cloud-based software.

And as more providers enter the market, prices will be driven down, Gallo Megraw said. The only downside banks see in switching to a newer core provider is that services could potentially be less reliable, as these are newer, less established products, she added.

Image by Bill Samatis | Special to Banker & Tradesman

Data Shows Spending Ballooning

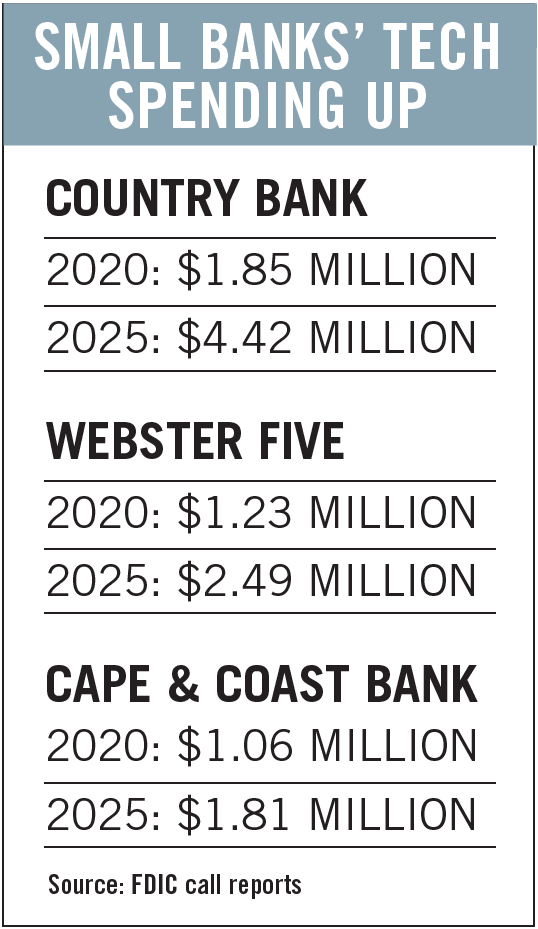

For smaller institutions, these costs are not a small line item, FDIC call reports show. For Webster Five, for example, its data processing expenses have increased from $1.23 million in its September 2020 call report to $2.49 million in 2025. Ware-based Country Bank saw these costs balloon by 138.8 percent to $4.23 million in the same time frame.

The call report line item is a proxy for what a bank spends on software technology such as its core provider services.

“Each organization obviously has to manage their core contracts or any vendor technology contracts they have, and make sure that they have that in focus, because those can exponentially increase if you don’t have the appropriate tools in place, like caps and the like,” said Marco Bernasconi, chief operating and innovation officer at Country Bank. “On an aggregate, you’re trying to manage down your spend, but it certainly can increase from three to eight percent per year, and without any of those mitigating factors, on average, it can increase even more. “So that’s constantly in focus, that’s really priority number one.”

Annual survey data published by the Conference of State Bank Supervisors Nov. 13 shows that along with high costs, smaller financial institutions spent a larger share of their budget on data processing than larger institutions since at least 2015. Data processing costs consumed 16.5 percent to 22 percent of small lenders’ budgets versus 10 percent to 14 percent for the quartile representing the biggest lenders.

Shortly before Thanksgiving, the Office of the Comptroller of the Currency asked community banks for information about “challenges community banks face related to contract negotiations and terms, fees, billing practices” and other issues they encounter dealing with core providers and third-party bank technology firms.

Seek Economies of Scale? Or Go It Alone?

Smaller banks blame low levels of competition among the three companies that provide banks’ operating software for their high technology costs. iStock illustration

It’s a burden on existing small banks, but it’s also a big barrier to entry new lenders, the Mass Bankers Association said.

“We at MBA are looking at varies ways we could potentially assist with an ‘economies of scale’ type approach to solve for the cost and vetting process,” the trade group said in a statement.

The rise in costs has also coincided with more consolidation within the banking industry itself, particularly among mutual banks banding together to share services.

“There’s economies of scale,” Bernasconi said. “They gain size and even if they are subsidiaries of a mutual holding company, they can leverage similar technologies and reduce vendors so cost benefits there. Community institutions that don’t exercise those opportunities, I think, will continue to manage expenses by focusing on areas. [They] can’t be everything to everyone – be really good at what you do to help manage down expenses and focus in.”

Some institutions still think it’s worth putting extra resources into technology investments as a way to fight off consolidation pressures.

“I think there’s a lot of consumers that are tired of being acquired and going through a conversion and so I think that it leaves a nice place for the long-standing community banks like Webster Five, who have been dedicated to investing in technology,” the Auburn-based bank’s Gallo Megraw said. “There’s no reason why anyone should be banking with a large bank and not with a community institution.”

Sam Lattof

Bankers Hope for Solutions

Most institutions either complain about their provider or opt to make a change to a different provider, Gallo Megraw said. She hopes to see more institutions opt for the latter.

“You can’t be with somebody that is subpar, that is costing you a lot of money and not delivering what you need to thrive,” she said. “To me, that that can’t be the method for growth, and it can’t be the method for growing our communities and providing our customers what they need. You have to be willing to cut bait and find the right provider and do the work.”

Gallo Megraw called on providers to be more transparent and allow community banks to openly discuss their contracts with other institutions. Outside of reducing their use of non-disclosure agreements, Gallo Megraw said she would like core providers to make early termination penalties and deconversion costs more equitable.

Some bankers hope that artificial intelligence technology can be another source of cost savings.

“That’ll be an opportunity to leverage that and grow the organizations and pay the people we have more, but not need to keep adding people because there’ll be more and more efficiencies, less simpler processes, they’ll be automated, and we can pay those people more that we have and go out and grow the organization,” Country Bank’s Bernasconi said. “I think there’s opportunity there with the right controls and risk mitigations and so forth.”

While it may seem tough to go up against one of the big three core providers, community banks can help one another out even by sharing things like automated, back-office technology workflows, Gallo Megraw said.

“Community banks could probably help each other a whole heck of a lot,” she said. “Rising tides are rising ships, and if you look around even Worcester County, there’s plenty of deposits for us all to thrive, all of the community banks.”