The 14 percent 2025 tax bill jump that Boston officials are looking to head off may simply be a down payment for more trouble to come, according to one prominent expert. iStock photo

The good news is that Boston’s looming tax revenue crisis, for now anyway, may not be as bad as some have feared.

Boston Mayor Michelle Wu is lobbying the Legislature for a green light to shift more of the city’s tax burden onto office buildings and other commercial properties.

If she succeeds, then Boston homeowners could get hit with a 9 percent increase to their tax bills.

But if she fails, then the city’s house and condominium owners will be forced to swallow a somewhat larger 14 percent increase in their annual bill, city officials said at a press briefing last week.

Neither scenario is great for Hub homeowners. But both are preferable to the 33 percent jump that city officials once warned might be coming, with the collapse in office tower values amid the shift to remote work having wrecked one of the city’s biggest tax-revenue cash cows.

And as for the owners of the struggling downtown office buildings and the businesses that rent space in them?

Well, it’s no secret they are waging their own State House lobbying campaign against Wu’s plan, arguing the last thing they need right now is to have the city hit them with higher tax rates.

A Bullet, Dodged?

After all the dire warnings of the past year, including a Tufts University expert’s estimate of a looming, $1.5 billion gap in city revenues over the next five years, it may seem like Boston dodged not one bullet, but dozens, with the naysayers having had a field day.

But a much more likely possibility, contends Greg Maynard, executive director of the Boston Policy Institute, is that what we are seeing now is just the tip of the iceberg.

Maybe that’s not so surprising. Maynard, veteran Democratic political consultant, launched BPI in 2023 with the aim of shedding light on the workings of Boston City Hall at a time when local coverage of politics and government is on life support.

A 501c4 nonprofit, BPI does not disclose its donors, though it would seem like a pretty good bet that business types with an interest in good government are among them.

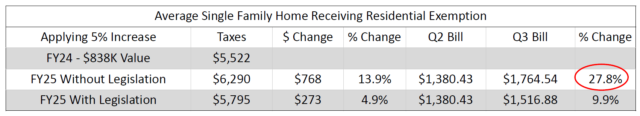

A table presented to reporters by Boston officials last week shows the average Boston single-family home will see a tax bill in January that’s 27.8 percent higher than their last one, and will see their total annual tax bill go up 13.9 percent. Image courtesy of the city of Boston

And it was BPI that first raised the alarm about that potential, $1.4 billion gap in city revenues over the next few years, having commissioned a high-impact study from Tufts’ Center for Sate Policy Analysis.

That said, there is a strong case to be made that we may be closer to the beginning than to the end of the office market implosion.

As they peg the value of homes and buildings across Boston, city assessors are using 2023 values, meaning there is nearly a 12-month lag between the numbers being discussed what’s actually happening downtown right now.

You would be hard-pressed to say that the state of the office market – and the value of many if not most of the buildings that comprise it – haven’t continued to fall over the past year.

The Worst May Be Ahead

In May, Moody’s Analytics warned that commercial real estate values could plunge by 26 percent overall by the end of 2025, with the office sector taking the toughest blows, CFO Dive reported.

In fact, CoStar is already pegging 2024 and 2025 as likely to be the worst years on record for the office market nationally as tenants bail on buildings and empty space continues to proliferate, according to The New York Times.

All of which means we could be seeing more increases in residential taxes in Boston in the years ahead as the office market slump takes its delayed toll on what was a once top source of city revenue.

Scott Van Voorhis

The 14 percent tax bill jump that Boston officials are looking to head off may simply be a down payment for more trouble to come, according to Maynard.

Of course, how it will all play out remains to be seen.

In that press briefing last Wednesday on the city’s tax situation, Nicholas Ariniello, the city’s assessing chief, noted that commercial values overall had declined 7 percent.

That was somewhat better than the initial 10 percent city officials had projected.

Ariniello noted that while older, class B and C office buildings are taking a significant hit in value, class A towers are holding up better.

But while encouraging as comments by Boston’s assessing chief may have been, we are still in the early innings here.

And given the undeniable changes to the office market and how we work, it would be foolish not to prepare for the worst.

Scott Van Voorhis is Banker & Tradesman’s columnist and publisher of the Contrarian Boston newsletter; opinions expressed are his own. He may be reached at sbvanvoorhis@hotmail.com.