Greater Boston’s clean energy sector has emerged as the nation’s fourth-largest industry cluster, but the fate of high-profile projects in Boston and Everett hinges upon approval of new procurement laws left in limbo in the past legislative session.

With nearly 99,000 jobs, Greater Boston trails New York, Los Angeles and the San Francisco Bay area in clean energy employment, nonpartisan environmental research group E2 said in a report released this week.

The state Legislature’s disagreement on language of a new energy procurement law jeopardizes the industry’s growth, including the emerging battery storage industry, the head of a nonprofit industry group said.

“Failure to pass a [procurement law] has the potential to hold back growth that means millions in investment,” said Joseph Curtatone, president of the Somerville-based Alliance for Climate Transition.

Without a legal framework, developers will be unable to obtain financing and the state will miss its own goals to lessen its dependence upon fossil fields, the former Somerville mayor predicted.

Two developers are proposing battery storage facilities in Everett and Brighton to tie clean energy projects such as offshore wind into the electrical grid.

In Brighton, Flatiron Energy is proposing a 62,000-square-foot battery storage facility called “Project Lite Brite” at 35 Electric Ave.

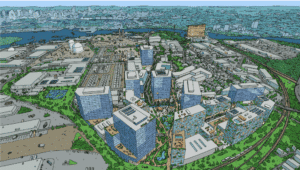

And in Everett, The Davis Cos. is seeking a fast-track approval from the Massachusetts Executive Office of Energy and Environmental Affairs for the first phase of its $500-million Docklands Innovation District development. Trimount Energy Storage is proposing a 700-megawatt battery energy storage on a portion of the former ExxonMobil tank farm property. The project is designed to store excess energy from renewable energy projects and tying into a nearby Eversource substation. Developers hope to break ground in 2026, according to project filings.

“The new [procurement] language is needed for those projects to move forward sooner or later, or they could be pushed back for several years,” Curtatone said.

The Davis Cos. declined to comment. The Boston-based developer hired Dewey Square Group as a lobbyist for Everett Landco, the legal entity that owns the Everett property, on July 1, according to a filing with the secretary of the commonwealth’s office.

Trimount Energy did not return a message seeking comment. Jupiter Power, the firm’s parent, has spent $58,255 in lobbyist fees to Rasky Partners and $30,000 to Wilby Public Affairs in 2024, according to a filing.

Flatiron Energy has paid $25,000 to Commonwealth Counsel, a lobbying firm headed by former state Sen. Joseph Boncore.

The Legislature failed to act on key pieces of legislation related to clean energy expansion in Massachusetts before adjourning its formal session on Aug. 1, including the new rules for siting and procurement.

Gov. Healey has attempted to revive the clean energy bill’s prospects by including it in a supplemental budget filed last week.

During the past session, Healey also proposed a 10-year, $1 billion package of financial incentives for clean energy companies, potentially catalyzing a promising source of real estate demand. Suburban developers have been looking to the clean energy sector as a lifeline amid the slump in the life science and office markets.

Companies typically require a mix of office, R&D and manufacturing space, making industrial and low-rise office properties suitable for conversions, developers say.

Nordblom Co. rebranded its Network Drive office park in Burlington as Blue Sky Drive in 2022 as it adds clean energy companies such as Nth Cycle, which leased 46,000 square feet in 2023.

King Street Properties has attracted clean energy tenants Ascend Elements, Commonwealth Fusion Systems and Electric Hydrogen to its Pathways campus at Devens.

And Nuvera Fuel Cells recently renewed a 110,684-square-foot lease for its headquarters at 129 Concord Road in Billerica’s Rivertech Park, after receiving $44 million in federal funding.

On a statewide basis, Massachusetts’ 123,000 clean energy jobs rank seventh nationwide, according to the E2 report. The largest local cluster is located in Middlesex County, which has more than 37,000 jobs.