Talent Crucial for High-Performing Mass. Resi Lenders

Having the right talent, meeting customers’ needs and institutional investment proved crucial for Massachusetts’ fastest-growing mortgage lenders this spring.

Having the right talent, meeting customers’ needs and institutional investment proved crucial for Massachusetts’ fastest-growing mortgage lenders this spring.

Residential lenders will have to continue to navigate elevated interest rates in 2025 but competition for customers will not be as fierce, some of the state’s top mortgage professionals predict.

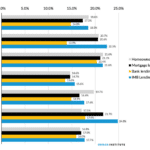

J.D. Power credits lenders trimming their staff in the reduction of quality customer service.

Residential lenders in Massachusetts think a challenging, high interest rate environment will continue to weigh the mortgage market down in 2024, pushing lenders to be more resilient and creative to attract more business.

Mortgage data provider Optimal Blue said mortgage refinancing saw a boost in December both nationwide and in Greater Boston as mortgage interest rates dropped from 20-year highs in the fall.

California-based home lender CMG Mortgage is expanding its Massachusetts footprint with the purchase of Rhode Island-based Shamrock Home Loans.

Rhode Island-based bank Citizens is exiting the wholesale mortgage lending business, five months after exiting the indirect auto lending business, as well.

The average long-term mortgage rate climbed further above 7 percent this week to its highest level since 2001, another blow to would-be homebuyers.

Greater Boston saw the steepest declines in lock volumes – sliding by 19.3 percent in July compared to June.

Cash is always king. But if that’s not an option, is a 40-year mortgage a good way for homebuyers to jump over the affordability hurdle?

Even though the Community Reinvestment Act does not apply to independent mortgage banks, these nonbank lenders provide a higher share of their mortgages in minority and low- and moderate-income neighborhoods than banks do, according to a new report from the Urban Institute.

Uncle Sam’s chief financial watchdog agency has fired a warning shot across the bow of consumer-facing comparison sites and mobile apps that steer consumers to the lenders that pay the sites the most.

The prospect of a spring mortgage market with fewer homes available for sale has Massachusetts lenders preparing for a challenging and competitive 2023.

An Illinois bank plans to hire 30 new loan officers and expand mortgage lending into several states, including Massachusetts, Connecticut and Rhode Island.

Mat Ishbia, CEO of Michigan-based United Wholesale Mortgage, talks about how the company became the nation’s biggest lender and what next next year holds.

Most homebuyers spend about as much time researching their next television purchase as they do their mortgage lender, compounding mortgage lenders’ struggles standing out from their competitors.

While borrowers might be expected to cite mortgage rates as the top reason for selecting a specific lender in the current environment, J.D. Power sees this as a potential problem for lenders.

After discontinuing mortgage lending earlier this year, Santander Bank has formed a partnership with Rocket Mortgage to provide home loans for the bank’s customers.

Brockton-based HarborOne Bank saw year-over-year earnings drop 30 percent as mortgage banking income fell by almost 50 percent in the second quarter.