Greater Boston Mortgage Refinances Picked Up in December

Mortgage data provider Optimal Blue said mortgage refinancing saw a boost in December both nationwide and in Greater Boston as mortgage interest rates dropped from 20-year highs in the fall.

Mortgage data provider Optimal Blue said mortgage refinancing saw a boost in December both nationwide and in Greater Boston as mortgage interest rates dropped from 20-year highs in the fall.

Two recently released reports raised hopes that the real estate market in Massachusetts might be reheating a bit after months of slower-than-normal activity.

New data from real estate data firm Black Knight shows that Boston-area residents are still raring to jump into the housing market, despite huge shortages in housing inventory and record-high prices.

Amid current economic conditions and the typically low demand for mortgages at year-end, mortgage applications at the end of December reached the lowest level since 1996, according to the Mortgage Bankers Association.

While homebuying activity typically falls off dramatically in November and December, the drop-off reported by Black Knight came as mortgage rates fell 50 basis points in three weeks.

October saw homebuyers’ ability to afford a home tumble yet again according to separate data reports yesterday.

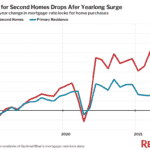

The number of homebuyers seeking mortgages for second homes has taken a nosedive this year, even as the inventories of single-family homes and condominiums for sale on Cape Cod hit never-before-seen lows last month.

Redfin’s monthly analysis of national-level mortgage rate-lock data shows demand for second homes has definitely cooled from last year, but it’s still elevated compared to the pre-pandemic norm.

Demand for vacation home loans is shaping up to be weaker this summer than mid-2020’s record highs, according to a new analysis of mortgage rate-lock data by economists at discount brokerage Redfin.

Wells Fargo & Co., the controversy-battered big bank, has a new problem – this time directly affecting mortgage applicants.