Boston Multifamily Construction Falling Far Faster than U.S.

Within the 50 biggest U.S. metros, only 294,000 multifamily units were permitted in 2024, Realtor.com said: a 7.5 percent drop from 2020.

Within the 50 biggest U.S. metros, only 294,000 multifamily units were permitted in 2024, Realtor.com said: a 7.5 percent drop from 2020.

The laws of economics apparently work differently in Massachusetts than in red states like Texas, according to some progressives here. Maybe they should look at some interesting new numbers released by Redfin and Zillow?

Rents are most expensive in large coastal markets, but are growing fastest in more affordable markets in the Northeast and Midwest.

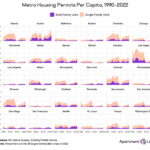

A new report from Apartment List researchers shows the dramatic disparity between housing production in Greater Boston and other parts of the country often touted as the region’s chief competition for residents and talent.

Something is happening when it comes to the development of new housing in Boston, and it’s not good: the number of homes getting teed up for construction is falling off a cliff.

As building costs soar, developers in Greater Boston are putting the brakes on new housing projects. And given the record high home prices and rents in the Boston area, this is the last thing we need.

Building permits in Massachusetts saw a steep decline in December 2018 compared to December 2017, according to new data from the U.S. Census Bureau.

U.S. homebuilding fell to a one-year low in September as Hurricanes Harvey and Irma disrupted the construction of single-family homes in the South, suggesting that housing probably remained a drag on economic growth in the third quarter.

U.S. homebuilding fell for a second straight month in August as a rebound in the construction of single-family houses was offset by persistent weakness in the volatile multifamily home segment.

U.S. homebuilding unexpectedly fell in April amid a persistent decline in the construction of multifamily housing units and a modest rebound in single-family projects, pointing to a slowdown in the housing market recovery.

U.S. homebuilding fell more than expected in March as the construction of single-family homes in the Midwest recorded its biggest decline in three years, but an increase in building permits suggested the housing market recovery remained intact.

U.S. housing starts fell more than expected in August as building activity declined broadly after two straight months of solid increases, but a rebound in permits for single-family dwellings suggested demand for housing remained intact.