MountainOne-Mechanics Cooperative Merger OK’d

North Adams-based MountainOne Bank and Taunton-based Mechanics Cooperative Bank have received all regulatory approvals required to complete the merger of their mutual holding companies.

North Adams-based MountainOne Bank and Taunton-based Mechanics Cooperative Bank have received all regulatory approvals required to complete the merger of their mutual holding companies.

The members of BrightBridge Credit Union and Arrha Credit Union voted in favor of merging following separate member votes at each credit union’s corporate headquarters.

The Federal Housing Finance Agency is increasing the size of home loans that the government can guarantee against default as it takes into account rising housing prices.

Erin Jansky was recently promoted to the position after joining the credit union in October 2024

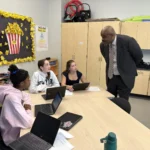

Financial literacy programs would be required in every Massachusetts public school system under a statewide graduation standards framework Gov. Maura Healey proposed Monday.

After beginning lease-up in mid-2024, the first residential tower at the Allston Yards development received $90 million in financing last week from Pacific Life Insurance Co.

Anxiety about an economic downturn is everywhere this fall. And if one hits, expect both traditional financial institutions and private lenders to take a step back from commercial real estate.

With its pending acquisition of Bluestone Bank, Mutual Bancorp will become the largest mutual holding company in Massachusetts but is operating in a relatively unique way under CEO Matthew Burke.

Bristol County Savings Bank announced its foundation was making a $25,000 grant to support the “revival” of the library at New Bedford’s Alfred J. Gomes Elementary School. See who else gave back.

The Federal Reserve’s top banking regulator on Tuesday released new guidelines for the agency’s supervision of the financial system, earning praise from industry trade groups and criticism from her predecessor.

Needham Bank and BankProv announced that the merger of their mutual holding companies has been completed.

From new VPs to fresh project managers, see who’s been hired, promoted and honored: It’s our weekly Personnel File roundup.

Banks took the Trump administration’s cuts to federal food aid programs during the government shutdown as a signal to step up their giving to food pantries: $270,000 alone in direct response to the cuts. See who else gave back.

Count Salem Five among the local banks now looking to high-touch, always-on customer service to generate more revenue from their best clients.

A vice president at Greenfield Savings Bank has been charged as part of a State Police sting operation targeting child sexual exploitation.

Fidelity Bank has appointed Thomas Galvani as director of community banking for the Leominster-based institution.

From new VPs to fresh project managers, see who’s been hired, promoted and honored: It’s our weekly Personnel File roundup.

Cambridge Savings Bank President and CEO Ryan Bailey says the bank will evaluate opportunities to grow its presence in the state, whether through more branch openings or merger and acquisition activity.

BayCoast Bank says it’s provided financing that has allowed the Veterans Association of Bristol County to purchase the Tuscan Building, located at 145 Globe St. in Fall River.

Nearly a year into the second Trump administration, Democrats atop Beacon Hill are not the only ones unable to shake a sense of economic agita.